Crypto prices showed a modest recovery over the weekend following heavy losses last week. As the US government resumes regular activity after a temporary shutdown, a number of key economic reports are set to be released. These updates may play a role in shaping investor expectations for interest rate changes and could influence movements across both financial and digital asset markets.

This week is shorter due to the Thanksgiving holiday, but several important economic figures will be made public, including inflation and consumer spending data. Markets will be watching for any signs of changing economic conditions.

Crypto Rebounds After Rough Week

Bitcoin recovered to $88,000 in early Monday trading after falling as low as $81,000 on Friday. It later dropped to $86,000 after facing resistance. This bounce followed comments about a possible rate cut by the US Federal Reserve, though expectations for a cut in December have decreased. One month ago, the chance of a cut was near 90%. It has since dropped below 70%, especially after the release of stronger-than-expected jobs data.

Crypto markets were not alone in the decline. US tech and AI stocks also fell last week, moving in the same direction as digital assets. According to Interactive Brokers’ Steve Sosnick, the current market conditions reflect a shift in risk appetite.

The total crypto market cap briefly touched the $3 trillion mark but is still down 32% from its peak in October. Bitcoin’s performance remains closely tied to economic signals, especially around interest rate changes. Many traders are now waiting for new data before making further moves.

Inflation and Consumer Reports Incoming

Several important US economic reports are due this week. On Tuesday, investors will see the September Producer Price Index (PPI), which measures how much businesses pay for goods and services. This number can give an early view of future consumer prices.

Also set for release on Tuesday are September retail sales, October pending home sales, and the latest consumer confidence reading from the Conference Board. These figures show how Americans are spending and how they feel about the economy. With the data backlog caused by the recent government shutdown, investors are watching closely for signs of change.

These reports are expected to influence how markets price future interest rate decisions. If inflation appears to be easing or spending slows, the odds of a rate cut could increase. On the other hand, strong figures may reduce the chances of lower rates in the near term.

Federal Reserve Updates in Focus

On Wednesday, the Federal Reserve will release the Beige Book — a collection of economic observations from its regional banks. While the report does not set policy, it gives a snapshot of business conditions, employment, and price trends across the country.

Alongside the Beige Book, the Fed will also publish the third-quarter Gross Domestic Product (GDP) report. This shows how much the economy grew over the summer. In addition, the Personal Consumption Expenditures (PCE) index will be released, a key measure of household spending and price changes used by the Fed in its inflation outlook.

These reports arrive ahead of the next Fed meeting and are likely to shape how investors view the path of interest rates. With less time for trading due to the holiday week, reactions may be more condensed.

Market Overview and Altcoin Moves

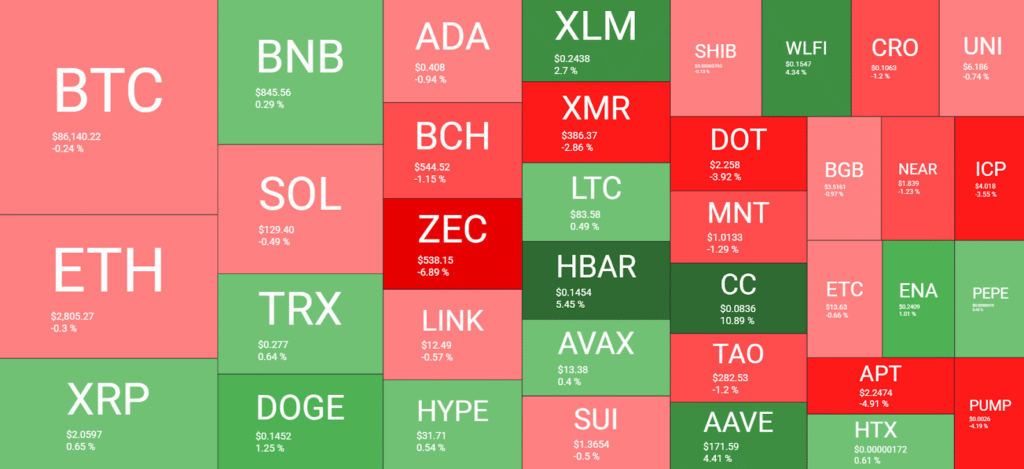

Bitcoin’s recovery has helped lift sentiment slightly across the crypto market, though many altcoins remain flat or in decline. Ethereum stayed above $2,800 but did not see strong gains. Other major coins like Solana, Cardano, and Chainlink were mostly in the red. XRP and BNB held small gains, while Zcash fell by 7% to below $540.

Some tokens posted stronger results. Hedera rose more than 5%, while MemeCore increased by 9% to trade above $1.90. Meanwhile, the total crypto market cap fell by around $30 billion and is again near the $3 trillion level.

With more economic data on the way, traders remain cautious. Crypto prices may continue to move based on interest rate expectations and overall risk sentiment. The focus now turns to how markets respond to this week’s wave of reports.