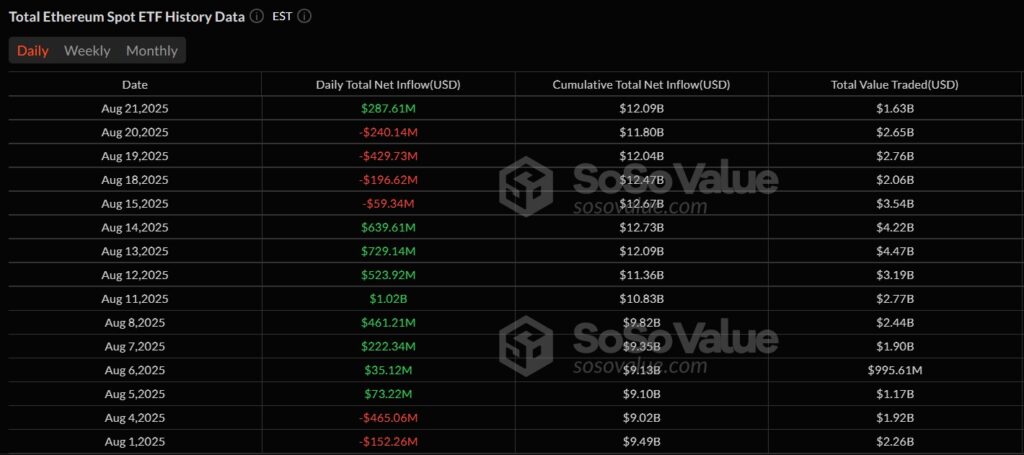

US spot Ether exchange-traded funds (ETFs) recorded a strong return to net inflows on Thursday after four consecutive days of outflows. According to data from SoSoValue, the combined inflow across all Ether ETFs totaled $287.6 million.

During the previous four days, Ether ETFs experienced more than $924 million in outflows. The largest single-day withdrawal occurred on Tuesday, with $429 million exiting the market. This followed another large outflow of $465 million on August 4, making these the two biggest daily net outflows in August so far.

BlackRock’s iShares Ethereum Trust (ETHA) led Thursday’s inflow activity, bringing in $233.5 million. The Fidelity Ethereum Fund (FETH) followed with $28.5 million in net inflows, while other ETFs combined added around $6 million.

The inflows brought cumulative net inflows for Ether ETFs to over $12 billion. According to analysts, this reflects renewed investor interest after a week of consistent selling. ETH’s price was last reported near $4,279 at the time of the inflows.

Ether ETF Reserves Now Hold Over 6.4 Million ETH

Data from the Strategic ETH Reserve (SER) shows that spot Ether ETFs now hold 6.42 million ETH. This amount is valued at approximately $27.66 billion and represents 5.31% of Ethereum’s total circulating supply. On Thursday alone, ETFs added 66,350 ETH to their reserves.

In addition to ETFs, corporate treasuries and long-term holders also continue to accumulate ETH. SER reports that companies and institutions hold 4.10 million ETH, worth $17.66 billion, outside of ETFs. These holdings represent 3.39% of the current circulating supply.

SharpLink Gaming Boosts Treasury Holdings With Major Purchase

SharpLink Gaming increased its Ether holdings earlier this week with a $667 million purchase. This pushed its total ETH treasury to over 740,000 ETH, now valued at around $3.2 billion. The company has become the second-largest ETH treasury holder, just behind Bitmine Immersion Tech, which holds 1.5 million ETH.

The continued accumulation by corporate entities follows broader interest in Ether among institutions. Ethereum’s role as the foundation for decentralized finance and various Web3 applications remains a focus for many treasury strategies.

Online Discussions Question Centralized ETH Holdings

The growing concentration of ETH among ETFs and corporate treasuries has led to debate within the crypto community. On Reddit, one user questioned whether institutional buying supports the Ethereum network or simply reduces supply.

Some argued that corporate holders help support ETH’s price and could strengthen the network through staking. Others expressed concern that large centralized holders reduce decentralization—one of Ethereum’s original goals.