REX-Osprey has changed the structure of its Solana exchange-traded fund (ETF), known as SSK SOL + Staking ETF. The fund now operates as a regulated investment company (RIC). The change went into effect on September 1.

Under this new model, the fund will no longer pay federal or state taxes itself. Instead, earnings and gains are passed on to shareholders, who report and pay taxes individually. This removes the issue of double taxation, which applied when the fund was structured as a C-Corporation.

Greg King, CEO of REX Financial, said the switch brings the ETF in line with how most funds in the U.S. are structured. “Investors still get exposure to Solana and staking rewards,” he said. The change aims to simplify tax treatment while keeping the same core exposure.

Shift Designed to Attract Broader Investor Base

The new setup is expected to make the fund more appealing to both retail and institutional investors. It removes some of the barriers tied to tax reporting and offers a structure that many investors are already familiar with.

By using a format common across other ETFs, the Solana fund may see greater interest from those who want access to Solana without buying and managing the token directly. The fund’s staking feature also remains active, allowing it to generate additional rewards for holders.

King noted that the goal is to provide a smoother experience. “This model supports growth while giving investors what they’re used to,” he said.

Assets Under Management Continue to Grow

The fund’s assets under management (AUM) have grown quickly. According to RexShares data, the fund now holds more than $212 million. This growth has come in a short time following the fund’s launch.

Market watchers believe the rise in AUM reflects strong demand. Investors are also watching for possible U.S. approvals of broader Solana-linked ETFs. Several recent SEC filings suggest decisions could come soon.

As more funds move toward traditional structures, some expect Solana-based products to be better positioned for future access through major investment platforms.

SOL Price Reacts to ETF Demand and Structure Change

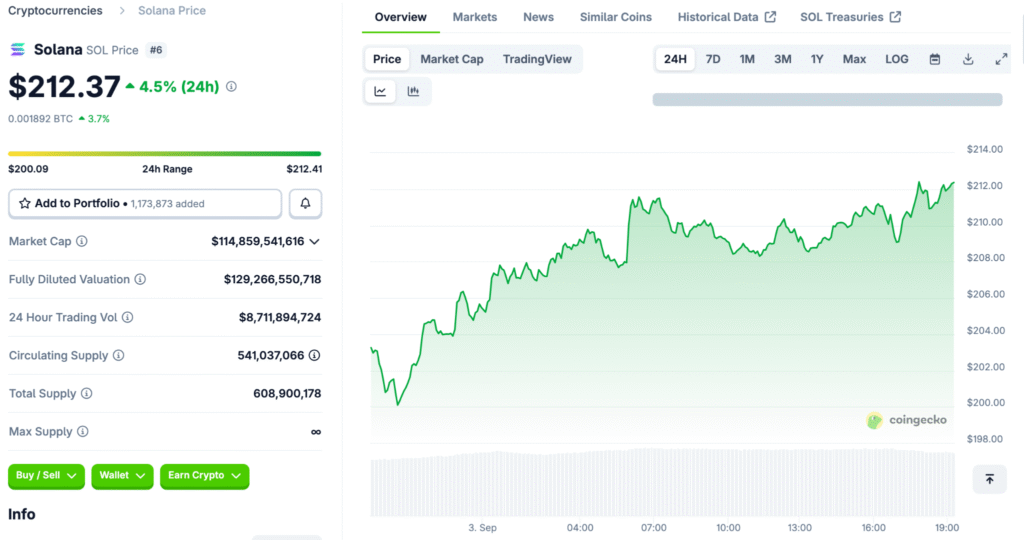

The price of Solana’s token (SOL) rose following news of the fund’s restructuring and the continued increase in assets under management. Trading data showed a bounce from around $208.50, with the price climbing past $212 during the overnight session, up almost 5%, based on Coingecko data.

The move came after steady gains in both fund inflows and general interest in Solana ETF products. Investors have responded to the new structure, and analysts continue to monitor price movement as more filings approach their review deadlines.