Key Takeaways:

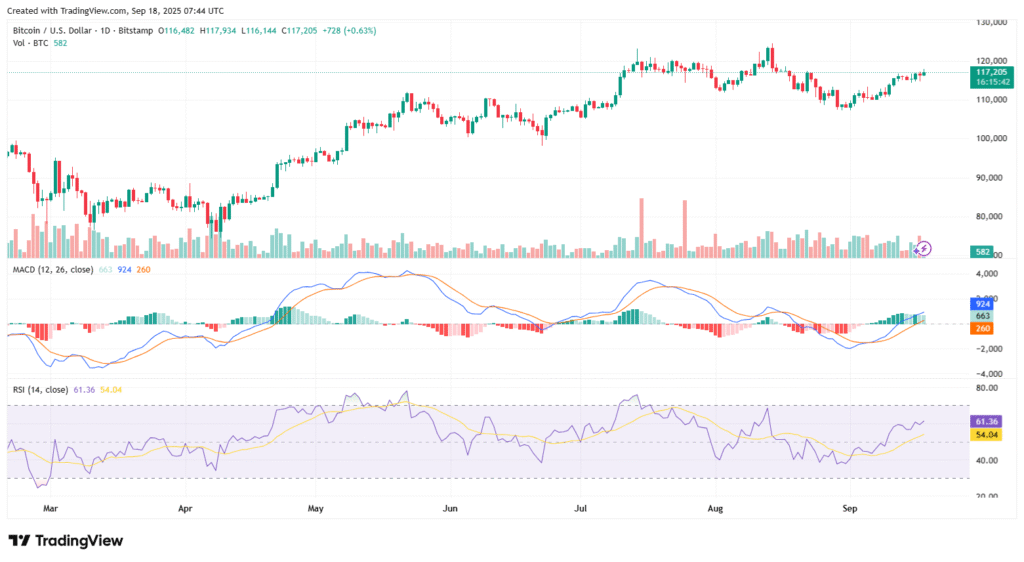

- Bitcoin faces key resistance at $117K, testing bullish momentum.

- Fed rate cuts support bullish market conditions for Bitcoin.

- Bitcoin could rise further, testing resistance levels near $118K.

Bitcoin has shown signs of upward momentum, trading just above $117,000 as the cryptocurrency market reacts to a series of significant economic developments. The price surge comes after the Federal Reserve cut interest rates by 25 basis points, alongside a more accommodating outlook on monetary policy.

These changes have given Bitcoin a fresh push, fueling optimism among traders and investors, especially as institutional interest in digital assets continues to rise.

However, Bitcoin’s journey to sustained growth is far from smooth. It is now facing a key hurdle around the $117,250 resistance level. If Bitcoin clears this barrier, the cryptocurrency could potentially surge toward the next significant resistance points at $118,500 and beyond. But if the price fails to break through, the bulls may retreat, leading to a correction toward the $115,500 support level.

Fed Rate Cut Boosts Bitcoin Price Momentum

On Wednesday, the U.S. Federal Reserve delivered its long-anticipated rate cut, lowering the federal funds rate by 25 basis points to a range of 4.0% to 4.25%. This move aligns with market expectations and suggests that the Fed may adopt a more dovish stance in response to weakening economic indicators, including a softening labor market and persistent inflation.

The Fed’s decision was met with a positive reaction in the broader crypto market, with Bitcoin and other digital assets gaining traction. Lower interest rates typically encourage capital to flow into riskier assets like Bitcoin, as traditional investments yield lower returns.

In fact, Bitcoin’s price rose by 0.1% shortly after the rate cut was announced, continuing to trade near the $117K mark.

Bitcoin’s potential for further gains is also underpinned by the U.S. Securities and Exchange Commission (SEC) approving a new set of listing standards for cryptocurrency exchange-traded products.

These rules, which streamline the approval process for crypto ETFs, could pave the way for more institutional funds to flow into Bitcoin. The SEC’s decision eliminates the need for case-by-case regulatory reviews, allowing crypto ETFs to be launched faster and with fewer regulatory hurdles.

Bitcoin’s Immediate Price Outlook and Potential Challenges

Bitcoin’s immediate price outlook remains cautiously optimistic, with the digital asset currently trading just below $117,300. The first major resistance zone is around $117,250, with the next target being $118,500.

If Bitcoin can hold above $117,250, it could experience a push toward the $118,000-$119,000 range, where further resistance lies.

However, there are still risks in the short term. If Bitcoin fails to clear the $117,250 resistance level, it could face a pullback toward $116,000, with support levels at $115,500 and $115,000 offering further protection. A deeper correction toward the $114,500 level could signal a broader retracement in the market.

Technical indicators for Bitcoin, particularly the 4-hour MACD and RSI, which are showing signs of strength. If these indicators remain bullish, the price could rise toward higher resistance levels. Conversely, if the momentum falters, Bitcoin may experience a temporary decline as traders lock in profits.