SEC Approves First Multi-Asset Crypto ETP

The US Securities and Exchange Commission (SEC) has approved the country’s first multi-asset cryptocurrency exchange-traded product (ETP). Grayscale’s Digital Large Cap Fund (GLDC) will be listed in the United States, giving investors regulated exposure to a mix of leading digital assets.

Per the filing, the fund will include Bitcoin (BTC), Ether (ETH), XRP, Solana (SOL), and Cardano (ADA). This approval follows the launch of spot Bitcoin ETFs earlier in the year and marks another step toward broader access to cryptocurrency through traditional investment products.

A multi-asset ETP allows investors to diversify without opening crypto exchange accounts or managing private keys. Market watchers note the timing coincides with rising expectations for an altcoin season, a recurring phase in bull markets when non-Bitcoin assets outperform. Coinbase suggested in August that historical patterns point to such a period beginning in September.

ASIC Grants Stablecoin Licensing Exemptions

Australia’s financial regulator has introduced a new framework for intermediaries distributing stablecoins. The Australian Securities and Investments Commission (ASIC) announced exemptions under the ASIC Corporations (Stablecoin Distribution Exemption) Instrument 2025/631.

The changes mean intermediaries distributing stablecoins issued by Australian financial services (AFS) licensees no longer need to obtain their own AFS or market licenses. ASIC explained,

“ASIC is committed to supporting responsible innovation in the rapidly evolving digital assets space, while ensuring important consumer protections are in place by having eligible stablecoins issued under an AFS licence.”

The exemptions apply only to stablecoins defined as financial products under Australian law and issued by AFS-licensed providers. Covered activities include secondary market dealing, market making, custodial services, and general advice. The regulator’s move is aimed at creating conditions for broader use of licensed stablecoins while retaining oversight of issuers.

Coinbase CEO Optimistic on US Market Structure Bill

Coinbase CEO Brian Armstrong has voiced confidence that the Digital Asset Market Clarity Act will move forward in Congress. The proposed bill seeks to assign responsibilities among US regulators, including the SEC and the Commodity Futures Trading Commission, for overseeing various areas of the crypto market.

Armstrong said after recent meetings with lawmakers,

“The Senate is strongly supportive of getting this done; the members I met with on both sides of the aisle are ready to get this legislation passed.”

He called the momentum behind the bill “a freight train leaving the station.”

The measure is designed to provide a framework for non-stablecoin assets such as tokenized securities and other digital products. Drafts are being circulated among committees and industry participants before heading toward a vote. Observers see the bill as the most comprehensive attempt yet to establish clear rules for digital asset businesses in the United States.

Wormhole Revises Tokenomics Model

Cross-chain protocol Wormhole has unveiled a new tokenomics structure for its native W token. The update includes a protocol-funded reserve, a 4% base yield for staking, and a change from bulk unlocks to biweekly unlocks.

In its announcement, the team stated,

“The goal of Wormhole Contributors is to significantly expand the asset transfer and messaging volume that Wormhole facilitates over the next 1–2 years.”

The revisions are expected to increase staking participation and strengthen governance, since voting rights are tied to staked tokens.

The W token gained more than 6% after the news. Launched in 2024, Wormhole has grown into one of the most active interoperability networks, processing asset transfers across multiple chains including Ethereum and Solana.

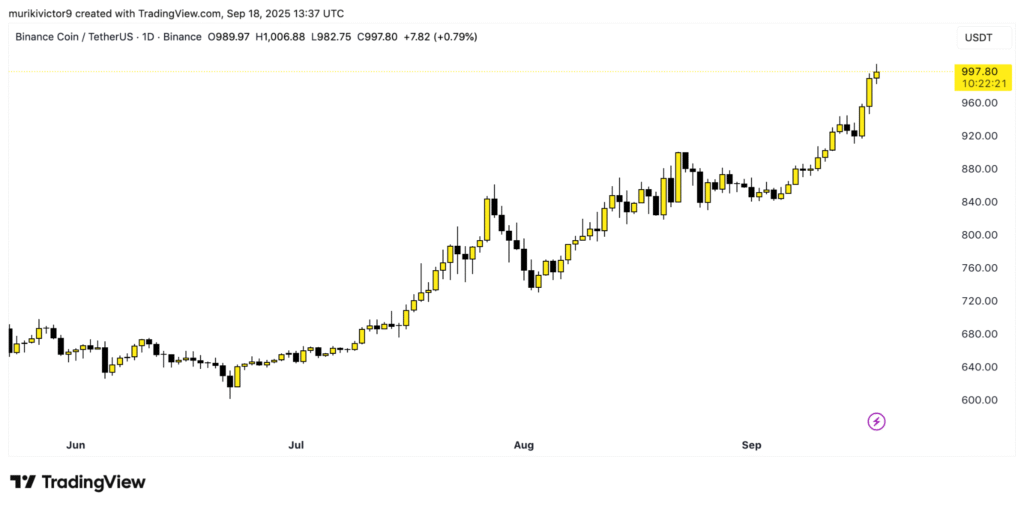

BNB Crosses $1,000, Surpasses Solana

BNB, the token powering the BNB Chain, has crossed $1,000 for the first time. It briefly touched $1,004 before settling near $992. Over the past day, it gained about 4%, adding to a weekly rise of more than 10%. The rally lifted its market value close to $140 billion, placing it ahead of Solana as the fifth-largest cryptocurrency.

The advance comes as Binance is reported to be in talks with the US Department of Justice to ease compliance obligations linked to its $4.3 billion settlement in 2023. The exchange has been under a court-appointed monitor since the agreement.

Traders point to optimism around those discussions, combined with a strong overall market, as drivers of the surge. BNB continues to play a central role in Binance’s ecosystem, offering fee discounts and powering applications across the BNB Chain.