Key Takeaways:

- Solana hits seven-month high with bullish momentum, nearing $250 resistance.

- Liveliness and NUPL indicators show selling pressure but profits haven’t peaked.

- A potential ETF approval could accelerate SOL’s rally toward $300.

Solana (SOL) continues to showcase remarkable bullish momentum, with its price climbing above $250 and hitting a fresh seven-month high. The altcoin has demonstrated resilience since early August, powered by institutional adoption and a broader market rally. With Solana’s price nearing the psychological $250 level, all eyes are on whether it can sustain this upward trajectory.

The rally is largely fueled by corporate adoption, as firms view Solana as a reserve asset. Despite mixed sentiment in the futures market, institutional interest has significantly reduced SOL’s risk profile.

Many firms, including Forward Industries and Sharps Technology, have amassed millions of SOL tokens, reflecting a shift toward integrating blockchain technology as part of their treasury strategy.

Rising Selling Pressure from Long-Term Holders

While Solana’s price action remains bullish, selling pressure from long-term holders (LTHs) threatens to hinder the rally. The Liveliness indicator has surged, indicating that a significant number of long-term holders are moving their coins, which typically signals profit-taking.

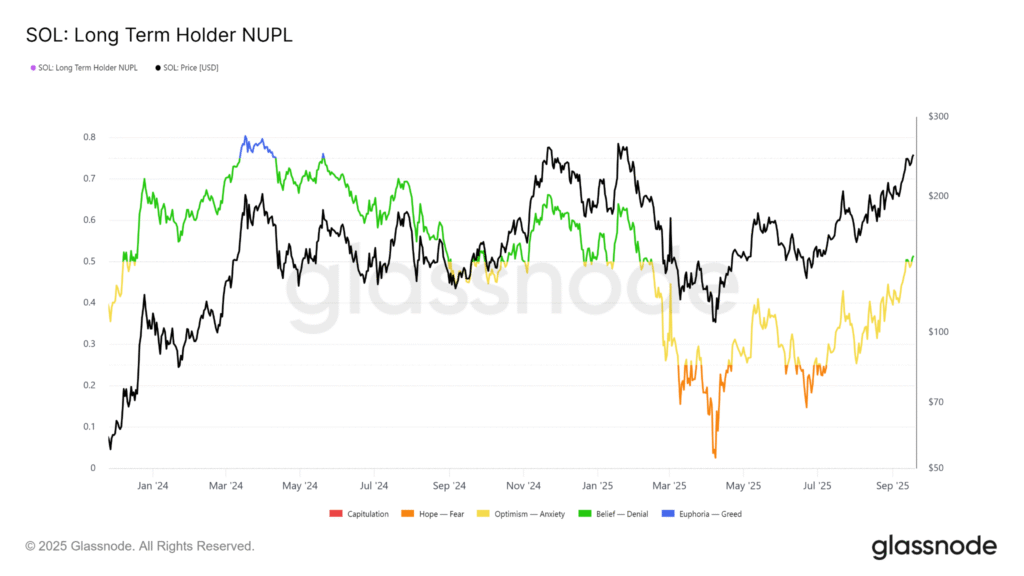

As SOL approaches its $250 resistance, there is concern that selling by LTHs could trigger a pullback, with a drop to $232 or even $214 if bearish momentum intenSolana LTH NUPL.

Solana LTH NUPL. Source; Glassnode

Despite this, Solana’s LTH Net Unrealized Profit and Loss (NUPL) metric reveals that profits for LTHs have not yet peaked.

Historically, NUPL values above 0.6 indicate when LTHs are likely to start liquidating, but current readings suggest room for further gains before a sharp reversal. This means that while selling is occurring, there is still potential for SOL to reach new highs.

ETF Approval Hopes and Corporate Demand Support Bullish Outlook

Solana’s rally is not solely driven by retail investors; corporate treasury strategies have played a crucial role in SOL’s recent surge. The total amount of SOL held by companies has crossed 17 million tokens, valued at over $4.3 billion.

This institutional demand, which mirrors strategies popularized by Michael Saylor’s MicroStrategy, indicates a growing belief in Solana’s future potential. Notably, companies like Helius Medical Technologies have allocated substantial funds to Solana, further solidifying its role as a reserve asset.

This increasing institutional interest is complemented by expectations that Solana could soon see an exchange-traded fund (ETF) approval in the US. Following the success of Ether ETFs, market analysts are hopeful that a spot Solana ETF could further propel the asset to new heights. The US Securities and Exchange Commission (SEC) has made strides toward approving crypto ETFs, which could pave the way for increased institutional inflows into SOL.

While Solana’s price is currently hovering just above $250, the altcoin could break through this level with sustained institutional support and moderate selling pressure from LTHs.

If SOL manages to hold above $250 and pushes toward $260, the next target could be $300. However, this will depend on how well the market absorbs potential sell-offs and the level of demand from both retail and institutional investors.