Key Takeaways:

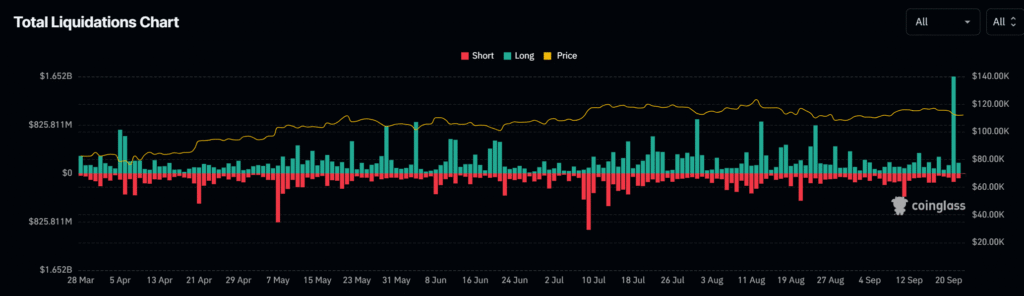

- Over $1.7 billion in crypto liquidations hit on Sept. 21, with 95% from long positions, signaling excessive bullish bets.

- Bitcoin dominance climbed to 59% on Sept. 22, drawing capital from volatile altcoins amid market caution.

- Altcoin Season Index dropped to 69 after peaking at 100, reflecting fading rotation and deeper corrections ahead.

- Fed’s 0.25% rate cut failed to lift sentiment; Powell’s remarks on high equity valuations added pressure.

The cryptocurrency market experienced sharp declines this week, erasing early September gains and pushing total capitalization below $3.9 trillion. On September 21, 2025, liquidations exceeded $1.7 billion. This is the largest single-day wipeout of the year, according to Coinglass data.

This event primarily affected long positions, which accounted for over 95% of losses, revealing widespread overexposure among bullish traders. Bitcoin traded below $114,000 by mid-week, while altcoins like Ethereum and XRP suffered drops of up to 7%

Liquidation Surge: Overleveraged Positions Unwind

Traders faced a brutal reckoning on September 21 when leveraged bets unraveled across major exchanges. Coinglass reported that $1.62 billion in long liquidations contributed to the total $1.7 billion figure, affecting over 407,000 positions.

This cascade began as Bitcoin failed to hold above $115,500, dipping below key support at $114,000 and the 100-hour simple moving average. Ethereum endured $210 million in liquidations after breaching $4,350 support.

The event marked the biggest liquidation wave since March 2025, per Business Insider analysis. High open interest in derivatives, surpassing $220 billion earlier in the month, amplified the fallout.

Futures trading volumes outpaced spot markets by eight to ten times, creating fertile ground for such volatility. Analysts at CoinGlass noted clusters of high-leverage positions both above and below current prices, which fueled the rapid unwind.

This liquidation frenzy did not stem from external shocks like geopolitical tensions but from internal market dynamics. Bitcoin’s rejection at $117,000 resistance confirmed a bearish head-and-shoulders pattern on daily charts, prompting automated sell-offs. The result left retail and institutional players nursing losses. The global market cap contracting 1.95% to $3.96 trillion by September 22.

Fed’s Cautious Stance Fuels Risk Reassessment

The downturn unfolded just days after the Federal Reserve’s September 17 announcement of a 0.25 percentage point rate cut, the first since December 2024. Chair Jerome Powell described the move as a “risk management cut” during his press conference.

He emphasized a balanced approach to softening labor markets and persistent inflation. However, Treasury yields climbed to a two-week high the following day, surprising markets that anticipated deeper easing.

Powell reiterated concerns on September 23, stating that equity prices appear “fairly highly valued” and that the Fed monitors financial conditions closely. He highlighted elevated inflation risks, noting potential persistent effects from policy shifts like tariffs.

This tempered outlook clashed with investor expectations for aggressive cuts, leading to a repricing of long-term risks. The S&P 500 fell 2.1% and the Nasdaq dropped 2.8% in the session after the FOMC meeting. The tech stocks bearing the brunt due to their sensitivity to rates.

Crypto markets, intertwined with equities, felt the ripple effects. Rising yields presented risk-free alternatives to volatile assets, prompting outflows from speculative holdings. The Fed’s dot plot projected two more cuts in 2025 but only one in 2026, signaling no rush toward zero rates.

Powell’s remarks underscored that monetary policy would proceed “meeting by meeting,” . This is based on incoming data like the upcoming Personal Consumption Expenditures index.

Market Sentiment Shifts as Dominance Rises, Altcoins Falter

Bitcoin dominance surged to nearly 59% on September 22, its highest since August. This is because investors sought refuge in the asset amid altcoin weakness. This spike reversed months of decline, indicating capital flight from higher-risk tokens.

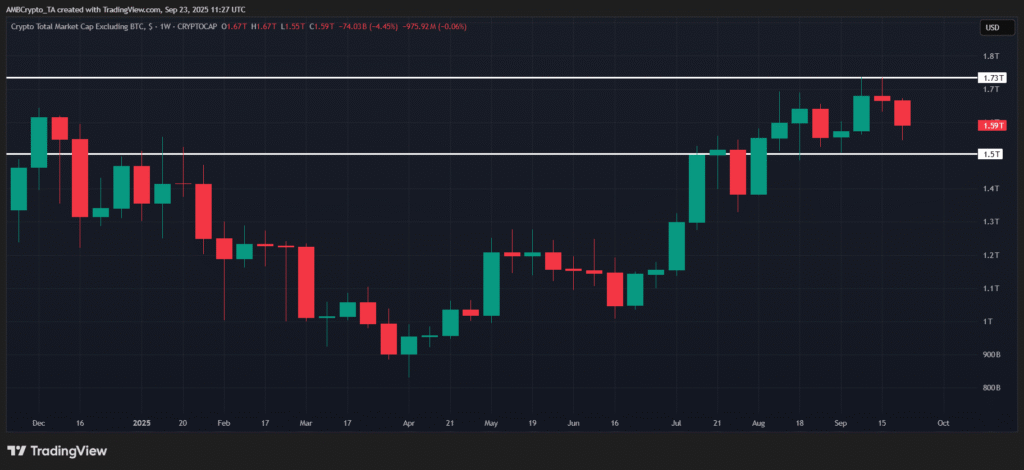

TOTAL2, the altcoin market cap excluding Bitcoin, fell 4.43%—twice Bitcoin’s loss—after rejection at key resistance around $1.73 trillion.

The Altcoin Season Index, tracked by CoinMarketCap illustrates this pivot. It briefly hit 100 on September 19, driven by speculative inflows into tokens like Aster, but retreated to 69 by September 24.

This fleeting peak, down from a September open near 59, underscores weak rotation. Ethereum dominance also trended downward by 2.86%, failing to bolster altcoins as it did in prior cycles.

CoinMarketCap’s Fear & Greed Index plunged into “fear” territory, reflecting heightened caution after early-month euphoria. Bitcoin hovered 3% above its $108,000 monthly open, while the overall market cap lingered near $3.70 trillion.

Analysts point to this divergence—Bitcoin holding ground while altcoins correct—as a sign of defensive positioning. Upcoming SEC decisions on crypto ETFs could provide a counterbalance, but macroeconomic releases will dominate near-term sentiment