Key Takeaways:

- A $1,000 XRP investment in 2020 grew to $10,700 by 2025.

- XRP outperformed LINK, Litecoin, Ethereum, and Bitcoin over the 5-year period.

- Despite legal challenges from the SEC, XRP showed strong growth.

- XRP’s price movement signals a potent ial new bull run or correction.

A recent post from Gemini has captured the attention of XRP enthusiasts by highlighting the substantial growth of the cryptocurrency over the past five years. According to the U.S.-based crypto exchange, a $1,000 investment in XRP made in September 2020 would be worth approximately $10,700 as of September 2025. This increase represents a tenfold return, with XRP’s price surging from around $0.265 to $2.84 during this period.

The 5-Year Growth of XRP Compared to Other Cryptos

Gemini’s comparison chart placed XRP’s growth in context with other well-known cryptocurrencies, including Chainlink (LINK), Litecoin (LTC), Ethereum (ETH), and Bitcoin (BTC). Over the same five-year period, XRP outperformed LINK, which saw a modest 1.94x return on a $1,000 investment, growing to about $1,940.

Litecoin, often regarded as a solid performer in the crypto space, showed even weaker results, with Gemini’s data estimating a $1,000 investment in September 2020 would have only grown to approximately $1,260 by 2025.

Meanwhile, Ethereum and Bitcoin, two of the largest cryptocurrencies by market capitalization, delivered returns of $10,104 and $9,310, respectively. While these returns are solid, they fall short of XRP’s remarkable performance. However, XRP’s growth was not the only notable one, as Dogecoin (DOGE) outshone all others, with a $1,000 investment turning into an astounding $85,000.

Despite XRP’s legal battle with the U.S. SEC, which began in December 2020, the cryptocurrency showed resilience, continuing to grow in value. The SEC’s lawsuit, which questioned whether XRP should be classified as a security, threatened to undermine Ripple’s business operations and XRP’s standing in the market.

Yet, even amidst these challenges, XRP displayed an impressive upward trend, particularly during the highs of 2023 when the coin hit a peak price of $3.65. At this price, the same $1,000 investment would have been worth about $13,750.

XRP’s Market Dynamics and Price Action in 2025

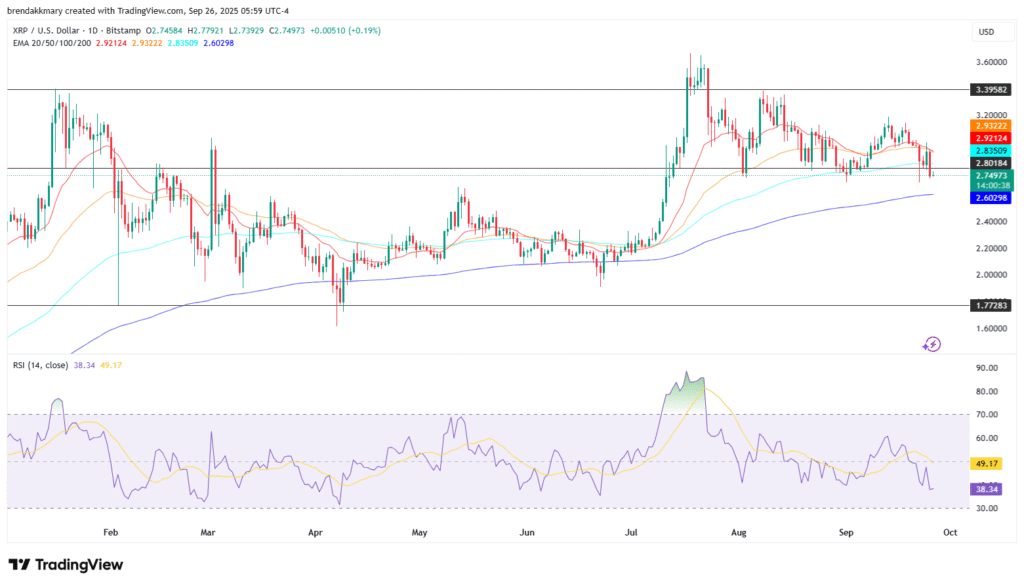

As of the latest data, XRP is trading around $2.74, just above its 200-day moving average and near its 100-day exponential moving average (EMA).

The coin has shown both bullish and bearish signs recently, with lower highs forming on the charts since August 2025, and recent trading action confined to a descending triangle pattern. The 200 EMA continues to act as a crucial support level, but a break below the short-term trendline could indicate waning momentum.

One of the key factors driving XRP’s continued relevance is its strong network activity and significant liquidity. On September 25, 2025, nearly a billion XRP coins — 925,865,148 XRP — were traded within a 24-hour period.

Large transactions of this magnitude often signal either major accumulation by institutional investors or a redistribution of holdings across exchanges. These large flows typically precede either increased volatility or a new price surge.This indicates a potential bullish breakout or another correction.

While the Relative Strength Index (RSI) is nearing oversold territory, hovering between 38 and 40, it has yet to hit extreme levels that would indicate a significant oversold condition. If XRP holds its support levels around $2.74 to $2.80, it could see a technical bounce.

However, recent spikes in selling pressure have dominated trading sessions, suggesting a slightly bearish sentiment in the short term. If the price holds above these key levels, a continued push toward $3.20-$3.50 remains a possibility.