Key Takeaways:

- Bitcoin trades at $113K after rejecting $116K resistance and bouncing from $110K support

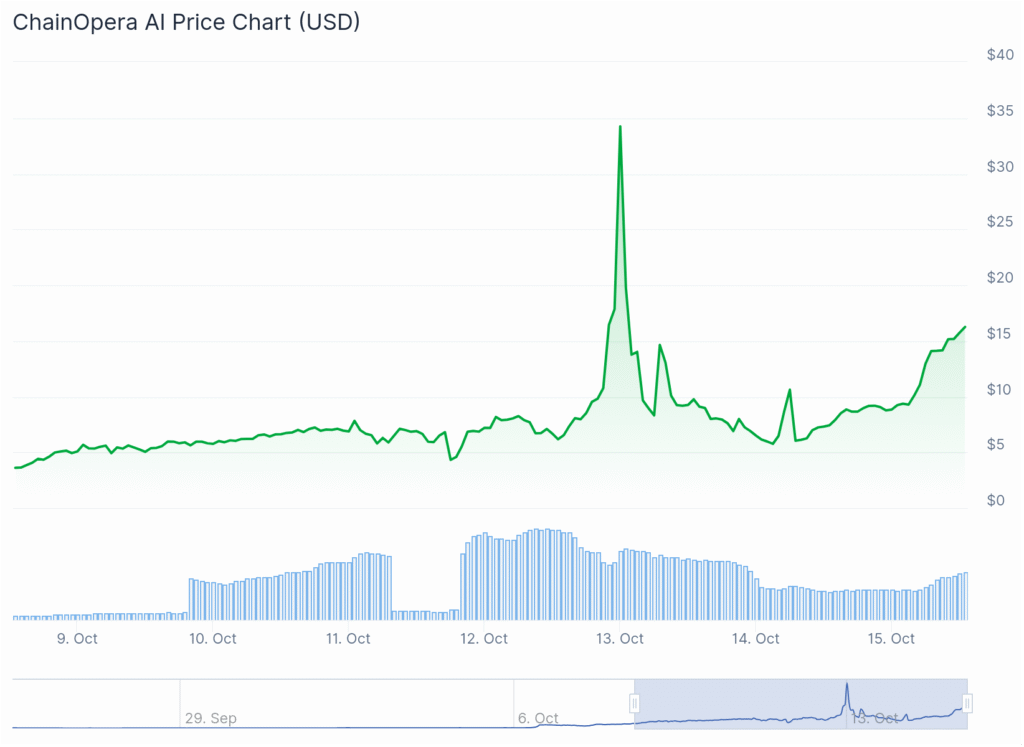

- ChainOpera AI’s COAI token leads altcoin recovery with massive 110% price surge

- BTC market cap reaches $2.25 trillion with dominance dropping below 57%

- Crypto market rebounds following $19 billion liquidation cascade from Trump tariff warning

Bitcoin maintains its position around $113,000 on Wednesday as cryptocurrency markets show signs of recovery following recent volatility. The leading digital asset experienced significant price swings over the past 24 hours, including a rejection at the $116,000 resistance level and a subsequent rebound from $110,000 support.

Meanwhile, altcoins demonstrate renewed strength with ChainOpera AI’s COAI token leading the charge with an explosive 110% surge, highlighting investor appetite for artificial intelligence-related cryptocurrencies.

BTC Faces Resistance After Volatile Week

Bitcoin’s current price action reflects the aftermath of last Friday’s dramatic market correction triggered by President Donald Trump’s tariff warning against China. The cryptocurrency plummeted from over $122,000 to $101,000 on some exchanges within hours, creating what analysts described as a bloodbath for over-leveraged traders.

The massive selloff resulted in 1.6 million trader liquidations, with total liquidation values exceeding $19 billion in a 24-hour period—marking the highest liquidation event ever recorded in cryptocurrency markets. Bitcoin had previously reached a new all-time high above $126,000 earlier in October, demonstrating the extreme volatility characterizing current market conditions.

The digital asset bounced immediately on Saturday morning, surging past $110,000 and continuing its climb throughout the following days. Tuesday morning saw Bitcoin peak at $116,000 before bears intercepted the upward movement and pushed prices back to $110,000 support levels.

Market Recovery Shows Altcoin Strength

Bitcoin’s market capitalization has increased to $2.250 trillion according to CoinGecko data, while its dominance over alternative cryptocurrencies has declined to under 57%. This decrease in Bitcoin dominance typically signals increased investor interest in altcoin opportunities.

ChainOpera AI’s COAI token exemplifies this trend, posting over 350% weekly gains that position it as the top performer among major altcoins during the current recovery phase. The surge reflects growing market enthusiasm for artificial intelligence-focused blockchain projects.

Many altcoins have followed COAI’s lead, bouncing significantly from yesterday’s correction levels. This broad-based recovery suggests that institutional and retail investors view the recent price dips as buying opportunities rather than indicators of long-term bearish sentiment.The cryptocurrency market’s rapid recovery from the $19 billion liquidation event demonstrates the resilience of digital asset markets and the strong underlying demand that continues to support higher price levels across multiple cryptocurrencies.