Key Takeaways

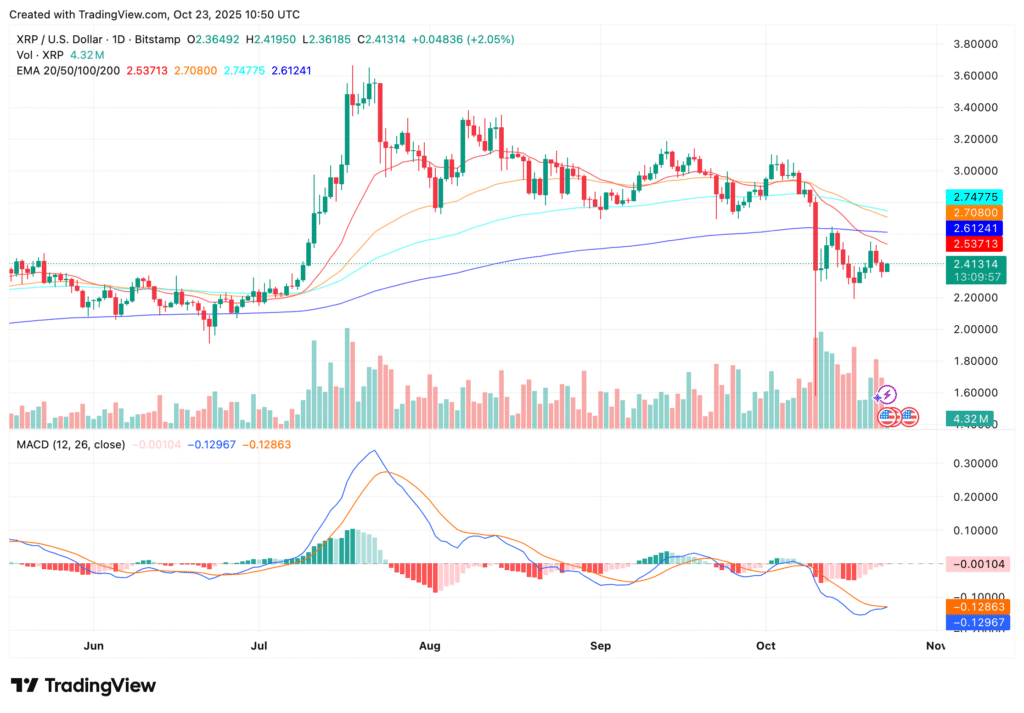

- XRP holds key support at $2.40 amid market uncertainty and mixed signals.

- Resistance lies at $2.62 and $3.00, with potential breakout targets above.

- MACD signals selling pressure, while RSI trends toward oversold territory.

XRP is currently trading around $2.41, holding firm above a critical support level at $2.40 after a volatile October. The digital asset has seen intraday highs and lows of $2.42 and $2.36, respectively, with a broader yearly range between $0.48 and $3.66. Despite recent price weakness, XRP has rebounded 7.5% over the past week and is up 438% year-on-year.

Technical signals remain mixed. The 50-day and 200-day moving averages, currently at $2.80 and $2.59, indicate downward pressure. However, a rebound above the 200-day EMA at $2.62 could confirm a bullish reversal. Immediate resistance lies at $2.75 and $3.00, levels that need to be cleared for a move toward $3.33.

Momentum indicators are diverging. The MACD is flashing a sell signal on the daily chart, and the RSI at 33 reflects building bearish momentum. Yet, short-term optimism persists as the 20-day SMA recently crossed above the 50-day SMA—often viewed as a trend-reversal signal.

Institutional Momentum and DeFi Growth Fuel Long-Term Outlook

Beyond technicals, fundamentals continue to improve. XRP’s market sentiment has turned cautiously optimistic amid rising institutional participation and DeFi expansion. Notably, asset management giant T. Rowe Price has filed to include XRP in a crypto ETF alongside Bitcoin and Ethereum, potentially expanding its visibility among retail and institutional investors.

XRP’s utility in decentralized finance is also increasing. The launch of FXRP on the Flare Network has drawn over $86 million in wrapped XRP, helping to position Flare as the top DeFi platform for the token.

Trading volume remains modest at 28 million XRP over 24 hours, well below the 222 million average, indicating consolidation. Still, analysts believe sustained movement above $2.75–$3.00, supported by higher volume and institutional flows, could trigger a rally to $5.00 in 2026. Forecasts for 2025 suggest a trading average near $2.83, with upside capped at $3.13 unless macroeconomic and regulatory conditions improve.