Key Takeaways

- Bitwise’s Solana Staking ETF debuted with $55.4M in first-day volume, signaling growing institutional interest.

- BSOL offers 100% exposure to Solana’s native token, providing a streamlined investment approach with staking rewards.

- Solana’s price shows positive momentum, trading near $199, with bullish technical indicators suggesting further growth.

Bitwise’s Solana Staking ETF (BSOL) made a remarkable debut on Wall Street, recording a trading volume of $55.4 million on its first day. This was the highest volume for any cryptocurrency ETF launch in 2025, surpassing other notable launches, such as REX Osprey’s Solana and XRP staking ETFs.

Solana Staking ETF Surpasses Expectations

The Bitwise Solana Staking ETF attracted significant attention, raising approximately $223 million in assets before trading even began. On its debut day, BSOL garnered $55 million in trading volume, demonstrating a robust appetite for Solana-related investment products.

The ETF is unique in offering 100% direct exposure to Solana’s native token (SOL), providing investors a streamlined method to gain exposure to the cryptocurrency without the complexities of managing digital assets directly.

The ETF offers the added benefit of staking, allowing the fund to pass along an estimated 7% yield from Solana’s staking rewards to its investors. This makes BSOL an attractive option for institutional investors looking to earn passive income while gaining exposure to Solana’s blockchain growth. In the first 30 minutes of trading, $10 million had already been traded, compared to $4 million for other ETFs in the same timeframe.

Wall Street’s Growing Interest in Solana

The strong performance of BSOL aligns with broader market trends showing increasing institutional interest in cryptocurrencies beyond Bitcoin and Ether. This trend has been amplified by the success of other cryptocurrency ETFs launched in 2024 and 2025.

Notably, BSOL’s debut surpassed the performance of earlier ETF launches in 2025, including the REX Osprey XRP ETF. BSOL’s introduction suggests growing confidence in Solana as an investment vehicle and the appeal of its staking mechanisms.

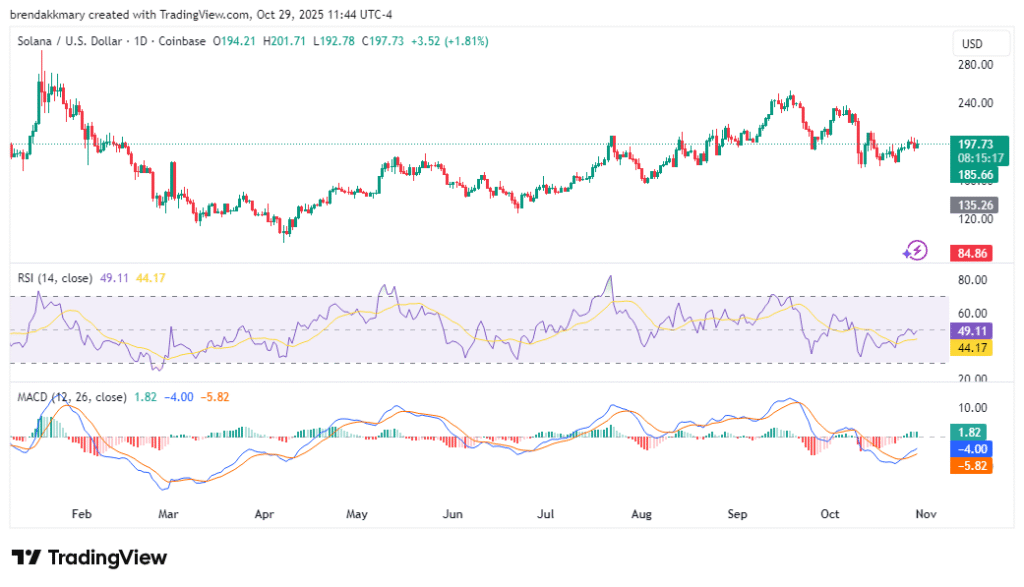

The Relative Strength Index (RSI) shows neutral buying activity, suggesting a balanced market for SOL. Additionally, the MACD indicator has signaled a bullish crossover, which could lead to further upward movement. Solana’s resilience in the face of market fluctuations, coupled with its strong institutional backing, positions it for potential short-term growth.

Solana’s price has been showing positive momentum, trading around $199 to $200 on October 29, 2025. The cryptocurrency has gained 2.63% in the last 24 hours, with a market capitalization nearing $92.9 billion. Technical indicators suggest that Solana could continue to see growth, with the 50-day moving average at $212.83 and the 200-day moving average at $178.13.