Bitcoin holds steady after a volatile week, Coinbase and major U.S. banks debate stablecoin rules, Robinhood posts major gains in crypto earnings, and Galaxy revises its outlook on BTC. Meanwhile, ZEC and ICP outperform the broader market.

Here’s a full recap of what moved the crypto space today.

Coinbase Opposes Proposed Stablecoin Interest Ban

Coinbase has submitted a response to the U.S. Treasury arguing that interest payments on stablecoins should not be banned across the board. The company said restrictions should apply only to issuers—not platforms like exchanges.

The comments came as part of the public response to the Treasury’s review of the GENIUS Act. This law aims to regulate how payment stablecoins are used in the U.S. Coinbase’s letter stated that the law was never meant to ban interest across the entire ecosystem.

At the same time, several large U.S. banking groups—led by the Bank Policy Institute—called for a full ban. Their statement urged the Treasury to block interest payments “whether paid directly by an issuer or indirectly by an issuer’s affiliates or partners.”

This group has raised concerns about capital moving out of the traditional banking system. In their view, offering yields on stablecoins could trigger large deposit outflows. They previously warned this could involve up to $6.6 trillion if not addressed.

The Treasury’s review marks the second round of public feedback on how the GENIUS Act should be enforced. There is still no official decision, but both sides have made their positions clear.

Galaxy Cuts Bitcoin Price Target for 2025

Galaxy has lowered its 2025 forecast for Bitcoin. The firm now expects Bitcoin to reach $120,000 next year, down from its earlier target of $185,000. The change was linked to lower price volatility and reduced momentum in recent months.

Alex Thorn, Head of Research at Galaxy, said Bitcoin is moving into what the firm calls a “maturity era,” marked by passive inflows, slower gains, and strong institutional presence. According to Thorn,

“If Bitcoin can maintain the $100,000 level, we believe the almost three-year bull market will remain structurally intact.”

He also pointed to a large amount of selling pressure from major holders in October. Around 400,000 BTC were offloaded during the month, weighing heavily on price action. Galaxy said this was a key reason for the market reset.

Another factor was the October 10 crash, which triggered about $20 billion in liquidations in a single day—the biggest such event in crypto history. The firm believes this event “materially damaged” current market momentum.

Despite the revised estimate, Galaxy continues to view Bitcoin as a long-term asset with steady adoption. However, expectations for explosive growth in the short term have been toned down.

Robinhood’s Crypto Revenue Rises Sharply in Q3

Robinhood reported a strong third quarter, with crypto-related revenue jumping over 300% compared to the same period last year. The company brought in $268 million from crypto trading, contributing to a total transaction revenue of $730 million—up 129% year over year.

Overall, Robinhood posted $1.27 billion in revenue for the quarter ending September 30, beating analyst expectations. The company also reported 61 cents earnings per share, higher than the projected 51 cents.

Robinhood has been expanding its crypto services throughout 2025. It recently acquired Bitstamp, a move aimed at capturing more institutional users. The platform is also developing new offerings such as tokenized equities and prediction markets.

Its stock (HOOD) closed 4.15% higher at $142.48 but slipped slightly in after-hours trading. The rise in crypto revenue is becoming a larger piece of Robinhood’s business as the company moves beyond its original stock-trading focus.

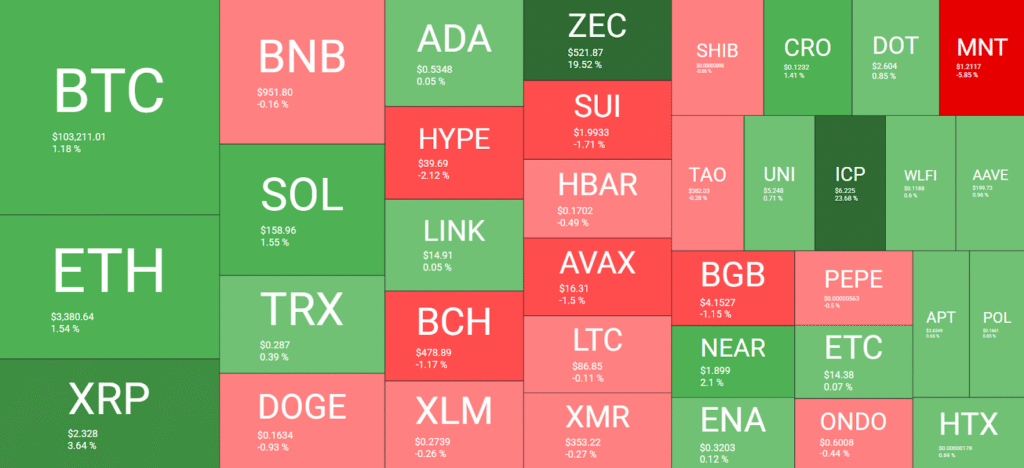

Bitcoin Recovers; ZEC and ICP Outperform

Bitcoin’s price rebounded after dipping below $99,000 earlier in the week. The asset touched $104,000 today but met some resistance and pulled back to $103,000 at the time of writing. Its market cap now stands at $2.06 trillion, with a dominance rate of 58.5%.

The move followed a steep two-day drop on Monday and Tuesday, when Bitcoin fell more than $12,000. That decline came after the Federal Reserve cut interest rates—a decision that some expected to lift prices, but instead led to a selloff.

While Bitcoin is showing signs of stabilization, some altcoins have seen stronger movement. Zcash (ZEC) gained over 20% in the past 24 hours and is now trading above $500, reaching a multi-year high. ZEC has shown consistent gains even when the broader market faced downward pressure.

Internet Computer (ICP) also posted a 24% gain, rising to $6.20. Other top assets such as Ethereum, XRP, and Solana had more modest moves. Ethereum remained below $3,400, while XRP saw a 3.7% increase and reclaimed its position above BNB in market cap.

Source: QuantifyCrypto

The total crypto market cap recovered to $3.5 trillion, rebounding from its recent low below $3.3 trillion. Bitcoin’s ability to hold above $100,000 remains in focus, with traders closely watching for direction in the days ahead.