Bitcoin dropped to its lowest point in over six months, falling under $97,000 during a volatile trading session. This came shortly after the US government passed a bill to end the shutdown, which initially lifted the market before sellers regained control.

Bitcoin climbed above $107,000 earlier in the week, supported by statements from Donald Trump about possible $2,000 tariff checks for Americans. The rally was short-lived. The cryptocurrency struggled to hold above that level and reversed direction within days.

By Wednesday, Bitcoin had dropped to $103,000 before briefly recovering to $105,000. After the bill to reopen the US government was signed, the price rose slightly but quickly turned lower again. Within 24 hours, Bitcoin lost more than $8,000 and touched $97,000.

Analysts Say Lower Levels Still in Play

The sell-off has brought renewed caution among traders. A trader known as Doctor Profit said the market may not be done falling. He pointed to a possible next move between $90,000 and $94,000.

“The worst is yet to come,” he said.

Others are watching key technical levels. Daan Crypto Trades pointed out that the price has broken below the June low of $98,000. He added that Bitcoin also dropped below the 200-day moving average and exponential moving average. These levels are commonly used by traders to measure longer-term strength. Their loss signals weakness in trend.

Meanwhile, the $107,000 level has now been tested and rejected several times. Michaël van de Poppe said the failure to break above that point led to new lows. He said,

The pattern of lower highs and lower lows continues to play out. With trading volume still elevated and sellers dominating, markets remain under pressure. Traders are now watching whether the $95,000 area will hold or if more downside is on the way.

Altcoins See Sharp Double-Digit Losses

The rest of the crypto market also turned red. AAVE, ENA, RENDER, SUI, PEPE, and LINK all fell by more than 12% in the last 24 hours. Ethereum dropped more than 11% and now trades below $3,200.

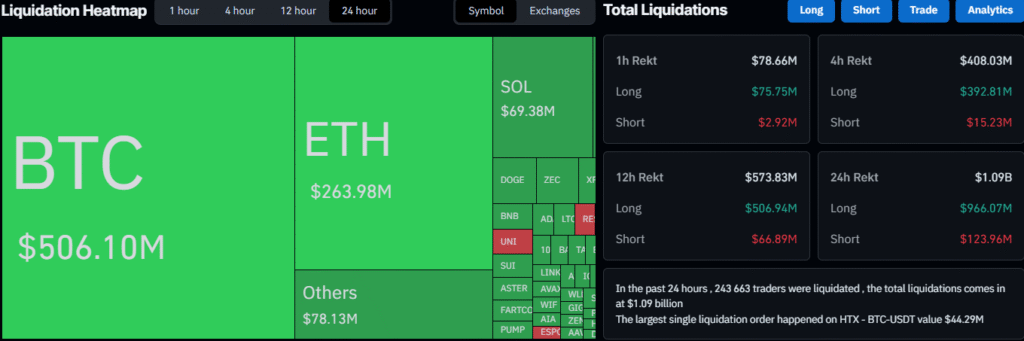

Data from CoinGlass shows total liquidations reached nearly $1.1 billion for the day. Long positions made up most of that number, with $966 million cleared. Short liquidations were far lower, at $124 million. The largest single liquidation was recorded on HTX, where a $44.29 million position was closed.

Source: CoinGlass

More than 240,000 traders were affected in total.