Key takeaways

- XRP reclaimed 2 dollars on a 7.19 billion dollar market cap jump.

- ETF launches boost institutional access but have not reversed bearish sentiment.

- Technicals and on chain losses keep downside risk elevated into the weekend.

XRP briefly moved back above the 2 dollar mark after one of its strongest single day capital inflows this quarter, even as broader digital asset markets remain under pressure. The jump has put the latest XRP price prediction debates in focus just as new spot ETFs prepare to expand institutional access to the token. Market data shows that traders are treating the bounce as a reactive move inside a still fragile downtrend rather than a clear bullish reversal.

By press time, XRP traded near 2.04 dollars, up more than 6 percent in 24 hours, while its market capitalization rose from about 115.30 billion dollars to 122.49 billion dollars in the same period, a roughly 7.19 billion dollar increase. On a seven day view, however, the token remains almost 10 percent lower and more than 50 percent below its 3.84 dollar all time high, highlighting the scale of the prior drawdown.

Macro backdrop and XRP price prediction into the weekend

Short term projections from derivative and on chain analysts outline an XRP price prediction band that still leans bearish for the current weekend. One widely cited scenario sees weekend highs capped around 2.00 dollars on Saturday and 1.98 dollars on Sunday, with potential lows stretching to 1.76 and 1.69 dollars respectively and average prices hovering near 1.88 and 1.835 dollars.

This cautious stance sits against a weak macro backdrop. Total crypto market capitalization has slipped to roughly 2.87 trillion dollars after weeks of forced liquidations and profit taking, while sentiment gauges such as the Crypto Fear and Greed Index sit in extreme fear territory near recent historical lows. Analysts note that heavy selling by high profile Bitcoin holders has added to the sense of fragility, keeping risk appetite for altcoins like XRP muted despite occasional relief rallies.

ETF inflows and supply risks for XRP

The latest XRP price prediction discussions are unfolding as ETF activity around the token accelerates. Bitwise’s spot XRP ETF recorded more than 100 million dollars in first day net inflows and over 25 million dollars in trading volume, joining existing products such as Canary’s XRPC fund that have steadily accumulated exposure. Grayscale is now set to list its own GXRP spot ETF on NYSE Arca on November 24, following regulatory approval and the conversion of its trust into a publicly traded vehicle.

Some market commentators argue that sustained ETF demand could eventually absorb up to 500 million XRP per day, tightening the available float on exchanges and altering liquidity dynamics over time.

For now, though, flows remain modest relative to the token’s market size, and recent sessions show that strong ETF launches can coexist with falling prices when broader risk sentiment and derivatives positioning skew negative. This disconnect has led several desks to frame their near term XRP price prediction as skewed to the downside until ETF accumulation grows large enough to offset ongoing spot and futures selling.

Technical levels signal cautious mood around XRP price

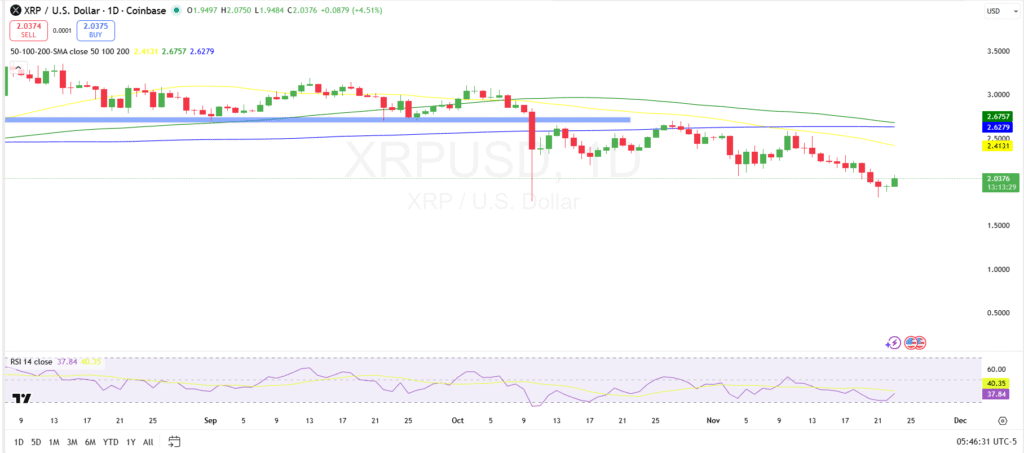

From a chart perspective, XRP still trades below its 50 day and 200 day simple moving averages, currently clustered near 2.48 and 2.65 dollars, which keeps the medium term trend pointed lower despite the latest bounce. Momentum indicators echo that message: the 14 day Relative Strength Index sits around 42, signaling only mild oversold conditions rather than a decisive reversal signal.

Additional levels tracked by traders include the 200 day SMA nearer 2.56 dollars and a pivot region around 1.94 dollars; XRP currently trades below both, reinforcing a defensive bias.

On chain data from Glassnode suggest that holders have realized roughly 75 million dollars in net losses in recent days, adding psychological pressure to an already nervous market. In this environment, analysts flag the 1.76 to 1.69 dollar zone projected for weekend lows as a key area where either fresh demand or deeper capitulation could shape the next leg of price action.