The crypto market saw key developments today. KuCoin expanded in Europe with new regulatory approval, South Africa stepped back from launching a digital currency, and Bitcoin posted its weakest November since 2019. Meanwhile, a system failure disrupted derivatives trading in the U.S., and Balancer moved forward with a plan to repay users after a major breach.

KuCoin Gains MiCA Approval in Austria

KuCoin has received a Markets in Crypto-Assets (MiCA) license from Austria’s Financial Market Authority. The license allows KuCoin EU to operate across 29 countries in the European Economic Area. Malta is excluded.

The exchange said the license is part of its compliance efforts in the region.

“Securing the MiCA license with our local entity in Austria is a defining milestone in KuCoin’s long-term trust and compliance strategy,” said KuCoin CEO Johnny Lyu.

Austria’s regulator has now issued MiCA licenses to six firms. These include Amina Bank, Bitpanda, Bybit, Cryptonow, and FIOR Digital. KuCoin said it chose Austria due to its clear regulatory process, legal stability, and access to talent.

South Africa Puts Retail CBDC on Hold

The South African Reserve Bank (SARB) has decided not to launch a retail Central Bank Digital Currency (CBDC) at this time. In a report released this week, SARB said it will focus on improving payment systems already in place.

The bank said a retail CBDC is possible but not a current priority.

“While the SARB does not currently advocate for the implementation of a retail CBDC, it will continue to monitor developments and will remain prepared to act should the need arise,” it said.

SARB’s goal is to improve access and reduce costs in the payment space. Ongoing work includes upgrades to infrastructure and wider inclusion of non-bank participants. About 16% of South Africans are unbanked, which raises concerns about digital accessibility.

The report also noted that a CBDC would need to meet the same standards as cash — offline use, low fees, wide acceptance, and privacy. These features are not yet fully supported by current technology.

SARB will continue to explore wholesale and cross-border uses for digital currency, where it sees more practical value.

CME Trading Halt Draws Criticism

The Chicago Mercantile Exchange (CME) paused all trading for nearly 10 hours after a system failure at its Illinois data center. The issue was caused by a cooling system fault. CME resumed operations by 1:30 pm UTC on Friday.

Traders were unable to place or exit positions. Many posted complaints across social platforms. One asked,

“How could a simple issue take down CME’s entire futures platform?”

Others pointed out the timing — the incident happened during Asian trading hours on a U.S. holiday, when volumes are usually lower. Some said trading stopped just before silver futures hit a key price point.

The exchange has restored normal service, but the incident has raised new questions about backup systems and platform stability.

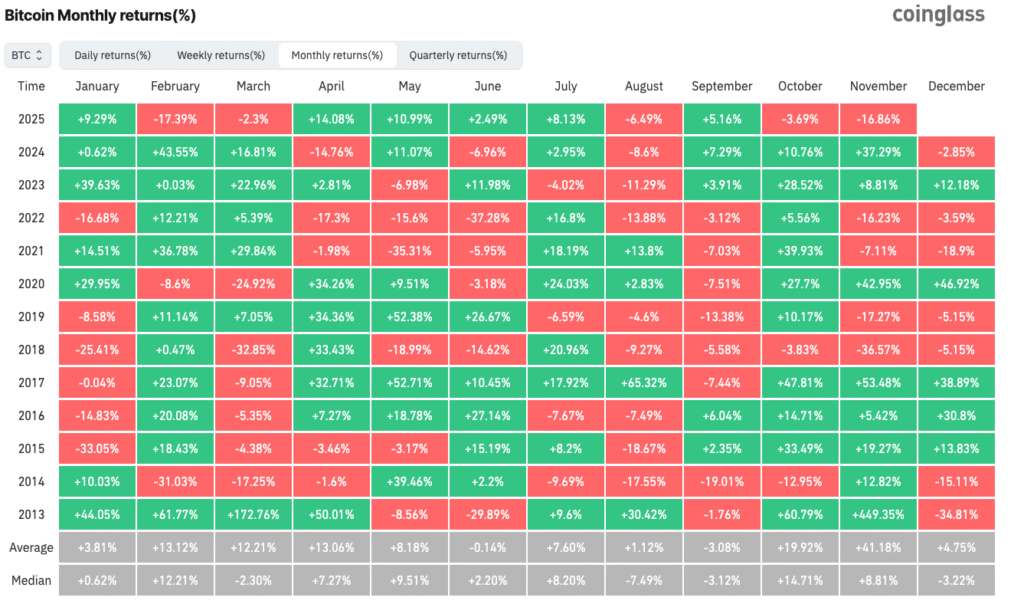

Bitcoin Set for Weakest November Since 2019

Bitcoin is down nearly 17% so far this month, its worst November since 2019. At that time, the price fell just over 17%. In 2018, during a major downtrend, the asset lost more than 36% in the same month.

Arctic Digital’s Justin d’Anethan said the launch of U.S. spot Bitcoin ETFs earlier this year may have changed how the market behaves. He said this shift may delay typical end-of-year trends, which often see strong gains.

Balancer Proposes Repayment Plan After Hack

Balancer community members have shared a plan to repay users after the protocol’s $116 million exploit earlier this month. Around $28 million has been recovered from white hat hackers, internal teams, and StakeWise.

The current proposal covers $8 million recovered by internal groups and ethical hackers. A separate process will be used for the $20 million retrieved by StakeWise.

The proposal recommends that payouts go only to affected pools. Users would be reimbursed based on their share, using the same tokens they originally held. This avoids price changes from swapping tokens.

Security firm Cyvers called the breach one of the “most sophisticated” attacks this year. The community is reviewing the plan, and final decisions on fund distribution are still pending.