Key Takeaways

- Bitcoin has fallen below $110K as Binance CEO CZ warns of more market declines ahead.

- Ethereum is trading under $4,000, signaling possible further downside for major cryptos.

- CZ cautions investors that market volatility will continue before a sustained recovery begins.

The crypto market is facing a sharp correction as Bitcoin dips below $110,000 and Ethereum trades just under $4,000. Binance CEO Changpeng Zhao (CZ) issued a direct warning to investors, suggesting that Bitcoin and Ethereum may not have reached their local bottoms, despite signs of temporary stabilization. His caution adds to growing anxiety as panic selling grips the market.

Bitcoin Falls Below $110K as Market Pressure Continues to Mount

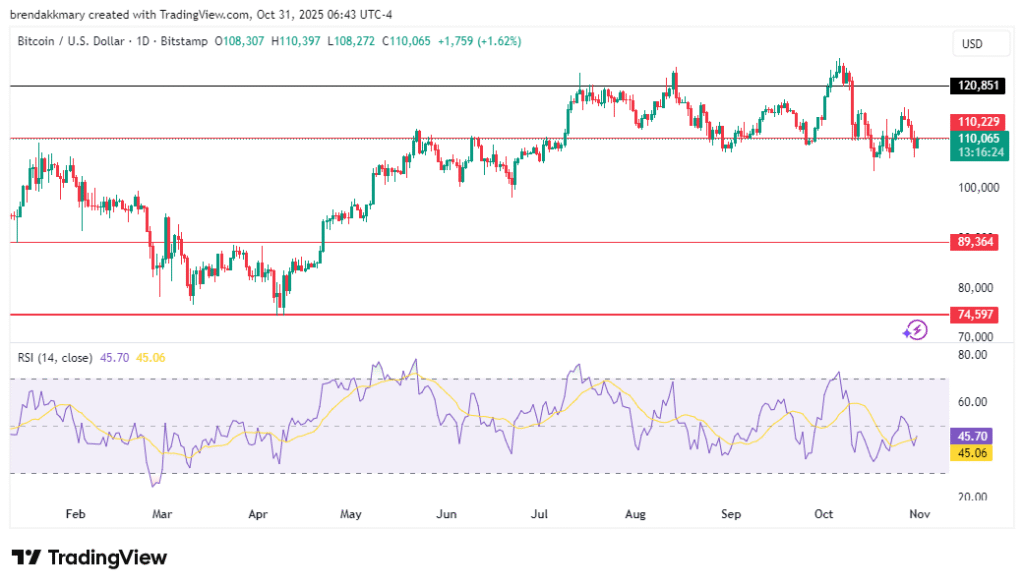

Bitcoin (BTC) dropped to $109,642 following a 0.5% decline in the past 24 hours and a 1.5% weekly slide. The drop pushed BTC below its crucial 200-day moving average, signaling a break in long-term support. Repeated failures to reclaim the $114,000 resistance level have further weakened bullish sentiment.

According to TradingView data, Bitcoin is at risk of falling to $106,000 or even $102,000 if the current support fails. The Relative Strength Index (RSI) hovers near 45, indicating that Bitcoin has not yet reached oversold conditions. High trading volume at $68.7 billion reflects active repositioning as investors respond to CZ’s market warning.

In his message, CZ reminded traders that “there will be many dips,” reinforcing that volatility is a feature of crypto cycles, not an anomaly. His comment aligns with previous market cycles where corrections flushed out overleveraged positions before a longer-term uptrend resumed.

Ethereum Breaks Key Support as Altcoins Suffer Steep Losses

Ethereum (ETH) fell 1.9% in the last 24 hours and 3.7% over the week to $3,831.49. The asset now sits below the $4,000 psychological mark after multiple rejections at the 100-day moving average. With the 200-day MA near $3,400, analysts warn that a further drop toward $3,200 is possible if current levels fail to hold.

Altcoins also recorded heavy losses across the board. Solana (SOL) fell 4.4% to $185.27, while BNB dropped 1.7% to $1,092.93. XRP lost 3.1%, Cardano (ADA) slipped 4.0% to $0.6114, and Dogecoin (DOGE) declined 3.2% to $0.1845. Market-wide selling pressure and declining dApp activity contributed to the downturn.

Despite the bearish conditions, small-cap tokens showed isolated resilience. Pippin (PIPPIN) jumped 100.1%, while IDIA and Aurora surged over 57%. These movements suggest some investors are shifting focus to high-volatility, low-cap assets for short-term gains.