- Bitcoin stabilizes above 90K amid a 25 fear index

- Zcash, MemeCore, and Cardano lead selective altcoin gains

- Market breadth remains weak, delaying the altcoin season

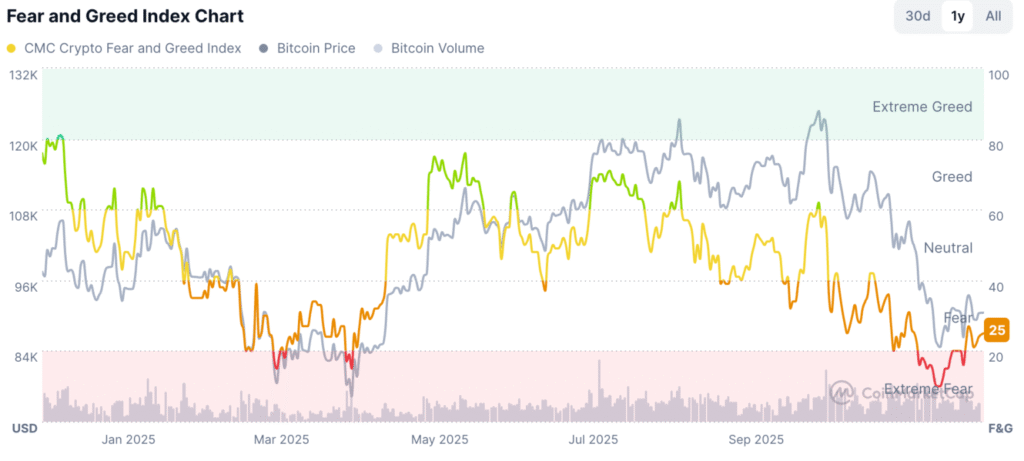

Bitcoin price continues to rise above the 90K mark as the market mood remains rather reserved, with the Fear and Greed Index at 25. The market is still absorbing the steep losses of late November, and traders remain reluctant to shift into riskier assets. Although liquidity, in general, has risen following the sharp drop, the majority of high-cap cryptocurrencies have not yet shown sustained energy beyond intraday reaction.

Bitcoin is trading marginally higher than its previous lows, and market sentiment suggests a still fear-based environment rather than a risk-appetitive one. Trading on key exchanges shows even-handed movements that support the perception that traders are waiting for clearer signals before taking on protracted positions. The subdued environment has presented a handful of altcoins with sprouts of potential, giving them fewer chances in an understated environment.

Bitcoin Support is biased with market volatility subsiding

Fear and Greed Index (Source: CoinMarketCap)

Zcash is one of the few assets seeing renewed interest following the first substantial recovery in weeks. The token increases approximately 10% over 24 hours, trading at approximately 426. In this move, Zcash has sharply fallen after reaching a high of about 700 in November, losing close to 30% in the month. The data from trading indicates deeper liquidity and increased volumes in the spot market across various venues and also shows that market participants are re-examining liquid privacy assets as volatility decreases.

The recovery is still small in comparison with the highs of the previous month, though the construction behind the action seems more stable. It is being distributed across multiple markets rather than the short spurts seen in other attempts to recover. This distribution implies wider participation and indicates that the attitude toward the token is stabilizing, with the overall fear of the market falling into the middle of twenty.

Famous MemeCore Gains Traction on Community Activation.

MemeCore has also improved; it is trading around 1.34 and is up nearly 9% in the last day. The token’s impetus aligns with the active involvement of its community, which continued to operate even in the face of unimaginable fear the previous week. Liquidity in its pairs has been consistent, and the asset has experienced short-lived upward movement whenever market pressure reduces.

MemeCore Price (Source: CoinMarketCap)

During the downturn, on-chain activity has been evident in staking and social features. This persistence has aided the project’s short-term success and highlights that traders tend to invest in tokens that are reinforced by their involvement rather than by solitary catalysts.

Megacaps remain within range, with Cardano moving upwards

Cardano is trading near 0.45c, up 3% in the last 24 hours. The shift is modest but steady, in line with trends observed in other large-cap assets, which have shown steady liquidity as Bitcoin levels have exceeded 90K. The trading volumes indicate measured participation rather than a robust accumulation, yet the asset retains its established position in risk-averse times.

These gains come with narrow market breadth. The progress of Zcash, MemeCore, and Cardano emphasizes selective power rather than overall recovery, making the altcoin season inaccessible at the moment.