Key Insights

- The Canary XRP ETF has received approval from the SEC, marking a key milestone for the cryptocurrency market.

- Nasdaq will list the ETF under the ticker symbol XRPC, allowing regulated access to XRP.

- XRP’s price recovery gains momentum with the ETF launch, as it aims for a test of resistance levels.

Canary Capital filed a Form 8-A with the SEC, registering its XRP ETF for listing on Nasdaq. The asset manager aims to launch the fund imminently, potentially as early as this week. This development positions the Canary XRP ETF as one of the first U.S.-listed products offering direct exposure to XRP.

Bloomberg ETF analyst Eric Balchunas highlighted the filing as a key step toward trading eligibility. The document, signed by CEO Steven McClurg on November 10, 2025, removes previous delays and enables automatic effectiveness.

The move follows Canary’s recent amendments to its S-1 application. Nasdaq can now approve the shares for trading, mirroring the rapid timeline seen with prior crypto ETFs like HBAR.

Canary XRP ETF Filing Details and Timeline

Canary Capital submitted the Form 8-A12B to register securities under the Exchange Act. This step finalizes preparations for the ETF’s debut under ticker XRPC. The filing clears the last regulatory hurdle, allowing the fund to list on Nasdaq. Analysts expect trading to commence between November 12 and 13, based on similar launches.

The ETF provides investors with spot exposure to XRP, held in custody. This innovation expands access to cryptocurrency beyond Bitcoin and Ethereum products. Market participants anticipate strong demand, given XRP’s role in cross-border payments.

From my years tracking crypto regulations, such filings often signal swift market entry, drawing parallels to the 2024 Bitcoin ETF approvals that boosted adoption.

Geopolitical Tensions Impact Crypto Landscape

China accused the U.S. government of stealing 127,000 Bitcoin from the LuBian mining pool in a 2020 cyberattack. The National Computer Virus Emergency Response Center (CVERC) linked the theft to a state-level hacking group, claiming U.S. involvement in the operation. Valued at $127 million then, the Bitcoin now exceeds $13 billion.

Beijing’s claims highlight escalating disputes over digital assets. The U.S. Department of Justice has rebutted, describing it as a lawful seizure from criminal networks. This friction underscores regulatory risks in the crypto sector, potentially influencing investor sentiment toward new products like the XRP ETF.

Comparisons to past hacks, such as the 2016 Bitfinex incident, show how nation-state actions can ripple through markets, adding caution to bullish trends.

XRP Price Momentum Amid ETF Excitement

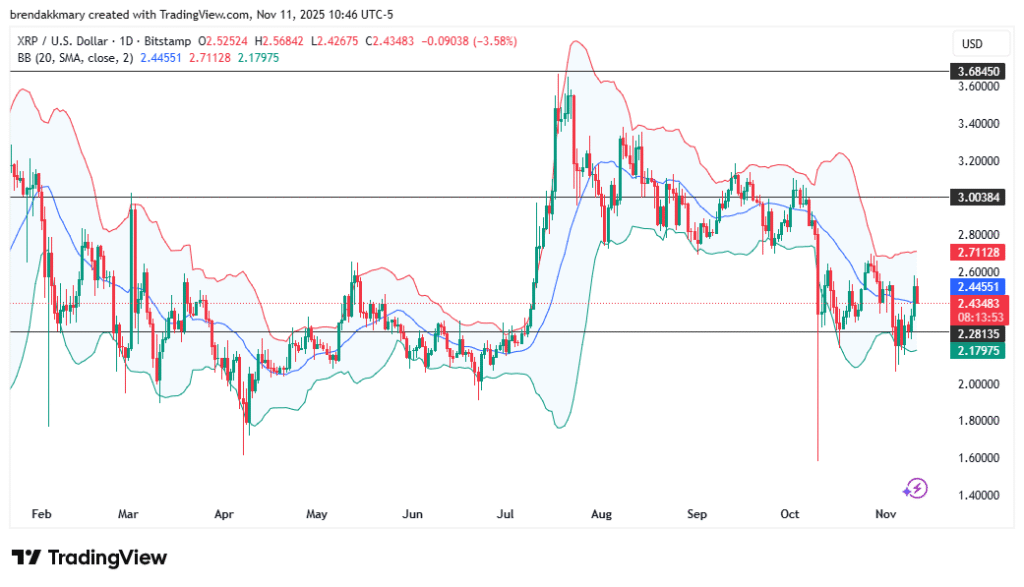

XRP rebounded from $2.20 support, trading around $2.45 after a 10% surge tied to ETF news. The token eyes resistance between $2.63 and $2.72, with analysts predicting a breakout if momentum holds.

Short-term gains faded slightly, with a 3.4% drop in the last 24 hours. However, the ETF approval fuels optimism. Failure to breach resistance could push XRP toward $1.90–$2.00 support.

Technical indicators, like Bollinger Bands, suggest volatility ahead. Similar ETF launches have driven 20-30% rallies in underlying assets, offering a critical test for XRP’s recovery.

The broader market context, including U.S. government reopenings, supports this uptrend, though geopolitical issues like the Bitcoin accusation introduce uncertainty.