Key Takeaways:

- ADA fell over 5% in 24 hours, breaking down from a descending channel pattern.

- Double death cross signals hint at weakening short-term bullish momentum.

- Whale wallets shed 20M ADA, signaling cautious sentiment amid growing volatility.

- ADA must hold $0.80 or risk deeper losses toward the $0.76 support level.

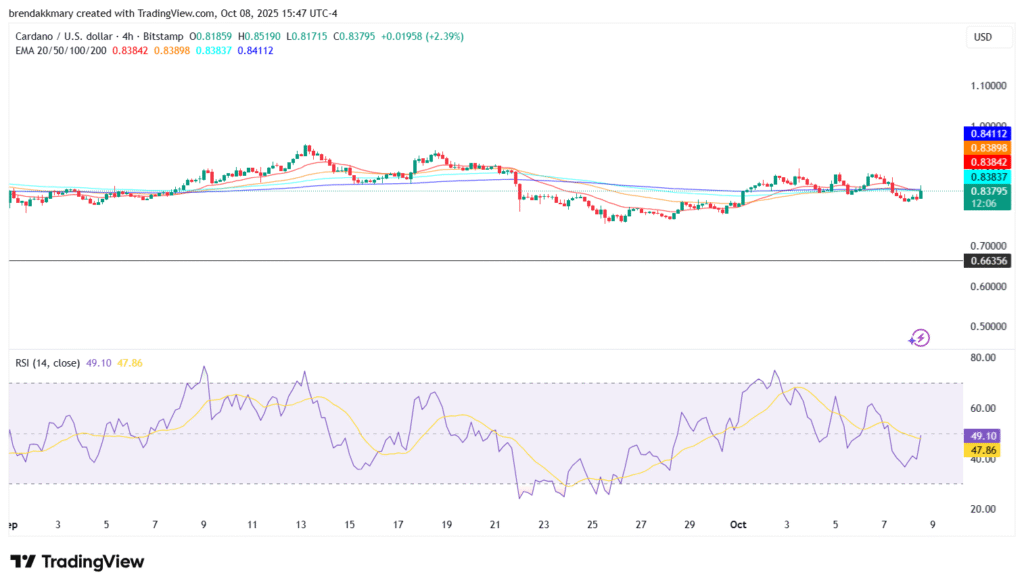

Cardano’s ADA token has declined sharply, dropping over 5% in the past 24 hours and slipping below critical support levels. The bearish turn follows a breakdown from a descending channel on the 4-hour chart, suggesting short-term momentum is fading. Technical indicators and on-chain data reveal a cautious stance from large holders, amplifying downside risks.

Despite the recent sell-off, ADA remains up 31% over the past three months. However, traders are closely watching for signs of further weakness amid volatile conditions and bearish signals on shorter timeframes.

Bearish Crossover and Whale Outflows Fuel Correction Risk

ADA’s short-term technical structure now shows a “double death crossover” on the 4-hour chart. The 20-period Exponential Moving Average (EMA) has fallen below both the 50- and 200-period EMAs. This configuration typically signals a shift toward bearish momentum.

Supporting this technical weakness is a drop in whale holdings. On-chain data shows that wallets holding 10–100 million ADA reduced their positions by 20 million tokens between October 6 and 8—a $16 million reduction at current prices. This decline, though modest, historically precedes volatile movements as large holders reduce risk exposure.

The price also broke down from a descending channel pattern, setting up a potential move toward the $0.76 support zone. Intermediate support at $0.78 could cushion the fall, but a sustained loss of $0.80 may accelerate the downside.

Futures Market Show Mixed Outlook

While technicals suggest short-term weakness, futures data shows heightened speculative interest. Open interest in ADA has climbed to $1.57 billion, up from $300 million in early 2024, indicating rising trader engagement. If this level holds above $1.5 billion, it may support a rebound as liquidity returns.

On the spot side, however, ADA saw $2.85 million in net outflows in October, showing ongoing caution among short-term holders. Nonetheless, institutional sentiment remains supportive. ADA’s inclusion in the S&P Broad Crypto Index Fund and Hashdex’s Nasdaq Crypto Index ETF boosts its exposure to traditional finance.

Additionally, the Cardano Foundation’s roadmap outlines aggressive ecosystem growth, including a $10 million RWA initiative and new governance mechanisms backed by 220 million ADA. These developments may strengthen the long-term outlook, even as short-term risks remain elevated.