Bitcoin rose sharply in the last 24 hours, climbing to a weekly high just under $92,000. The move helped the total crypto market regain over $130 billion, pushing its value above $3.2 trillion on CG. While many altcoins showed gains, most were outpaced by Bitcoin, whose dominance also grew.

Bitcoin Pushes Past $91K After Sharp Recovery

Bitcoin dropped below $81,000 last week, hitting its lowest level in over seven months. The decline followed a $25,000 slide in under two weeks. After reaching that low point on Friday, the price began to rise. It first climbed past $84,000, then pushed higher through the start of the new week.

Attempts to break through $88,000 and $89,000 were met with resistance. Late Wednesday night, the price finally broke above $90,000 and continued to rise, reaching just below $92,000 by early Thursday.

Bitcoin’s market cap now stands at $1.83 trillion. Its dominance rate has increased to over 57%, rising from levels below 56.5% earlier this week. This shows that recent inflows have favored Bitcoin over other digital assets.

Altcoins Follow, But Gains Are More Limited

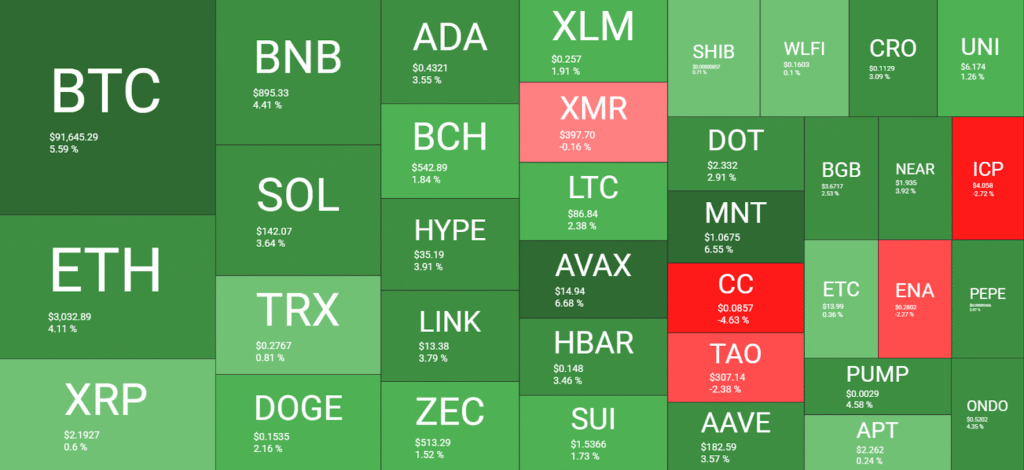

Most altcoins moved higher as Bitcoin climbed, but few saw stronger gains. Ethereum is trading above $3,000, up more than 4% in the past day. XRP recovered to $2.20, while BNB, SOL, LINK, ADA, and HYPE saw increases between 3% and 5%.

Among larger-cap tokens, Avalanche (AVAX) and Mantle (MNT) posted gains above 6.5%. Kaspa (KAS) led the market with a 21% jump. Other strong movers included Flare (FLR), up 11%, and Sky (SKY), up 10%.

Source: QuantifyCrypto

Despite the bounce, altcoins are still behind their recent highs. Most remain well below peak prices seen in October, following a sharp selloff earlier in November that erased more than $1 trillion from the market.

Analysts Expect Altcoin Rotation Phase

Market analysts are watching for signs that funds may shift from Bitcoin into altcoins. The TOTAL3 index, which excludes Bitcoin and stablecoins, is being closely followed for early signals of such movement.

One analyst posting under the name “Stockmoney Lizards” noted:

“Bitcoin dumps → Money to stables → Stables wait → Then rotate to alts. We’re in the waiting phase.”

This view suggests a pause before a broader altcoin rally.

Michaël van de Poppe, founder of MN Fund, said: “It’s the end of the bear market for altcoins.” He added that the current market structure doesn’t follow the usual four-year cycles seen in the past and may extend longer.

Another analyst, “Sykodelic,” pointed to chart patterns from previous cycles, saying,

“It honestly couldn’t look better here… we’re in the exact same position before mega altcoin expansion.”

Market Cap Reclaims $3.2 Trillion as Momentum Builds

The total crypto market cap has grown by over $130 billion in one day, returning to the $3.2 trillion level. This rebound was driven mostly by Bitcoin’s price rise, with altcoins showing mixed but positive performance.

While the broader market is recovering, current levels still remain below those seen before the November downturn. Many tokens continue to trade at heavy discounts from their October peaks. Market participants are now watching closely to see if Bitcoin’s strength leads to a wider shift toward altcoins in the coming weeks.