Here’s what happened in crypto today, a round-up of key developments shaping the digital asset market. From the rapid growth in DeFi lending to comments on ETH treasury risk and a new joint move from U.S. regulators, here are the top stories moving the crypto space.

DeFi Lending Sees Sharp Increase in 2025

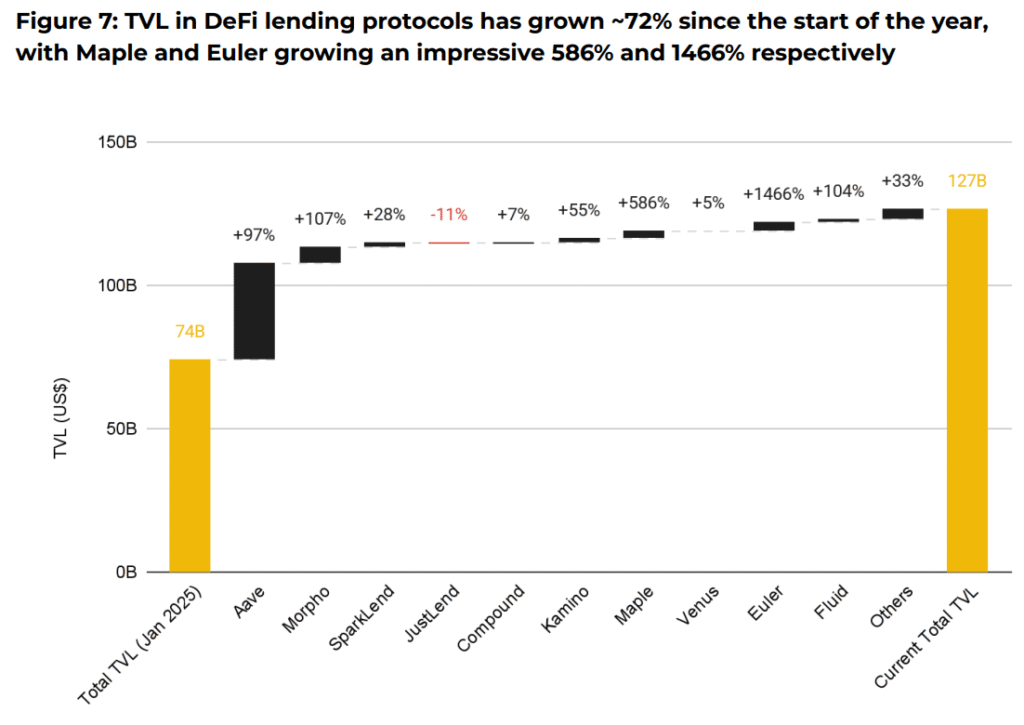

Decentralized finance (DeFi) lending platforms have grown fast this year. Total value locked (TVL) rose from $53 billion in January to more than $127 billion this week, showing a 72% increase in under nine months. The data comes from Binance Research.

These platforms use smart contracts to let users borrow and lend assets without going through banks or brokers. The growth is being driven by more interest from large financial firms, especially in using stablecoins and tokenized versions of real-world assets such as bonds or property.

Binance Research pointed to rising demand from institutions that are looking for new ways to earn yield and settle trades more efficiently. DeFi lending now plays a key role in how these firms explore blockchain systems and digital markets.

More capital flowing into DeFi means the sector is becoming a bigger part of the digital asset economy. As traditional companies look to blockchain for both savings and returns, lending protocols are becoming a main entry point.

ETH Treasury Firms May Be Taking on Too Much Risk

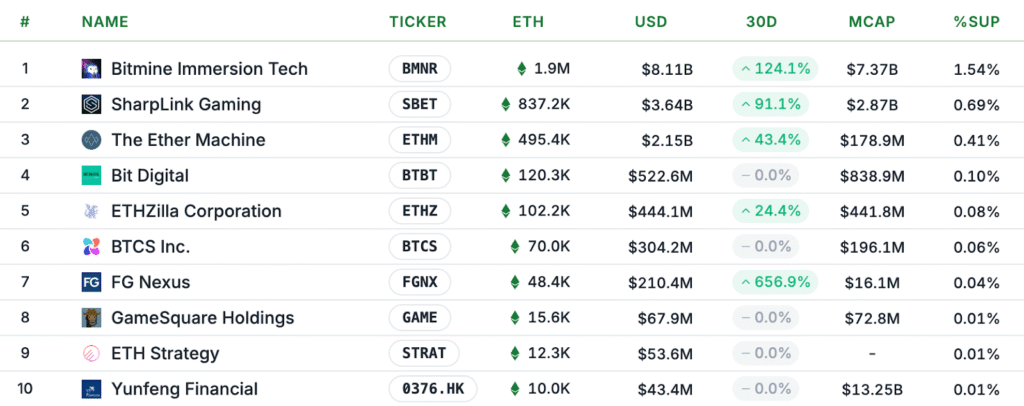

Joseph Chalom, co-CEO of Sharplink Gaming, warned this week that companies holding large amounts of Ether (ETH) may be exposing themselves to major losses if prices drop. Speaking to Bankless, Chalom said some firms are chasing high returns without enough caution.

“There will be people just like in traditional finance who wanna get that last 100 basis points of yield, and think that it is riskless,” he said.

Chalom noted that while some methods offer high returns, they also come with added risks. If the market drops sharply, companies focused only on profits could suffer large setbacks.

Sharplink Gaming currently holds $3.6 billion worth of ETH. It is the second-largest public ETH holder, just behind BitMine Immersion Technologies, which has $8.03 billion.

Chalom said some companies may be making poor decisions in how they raise funds or how they report returns. He raised concern that risky moves could hurt the reputation of the crypto treasury sector.

“If you overbuild and there is a downturn, how do you make sure your call structure is in such a way that you build to the highest price of Ethereum?” he asked.

SEC and CFTC Provide Clarity on Spot Crypto Trading

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) issued a joint statement on Tuesday. The agencies confirmed that U.S. and foreign exchanges can list spot crypto assets if they follow existing rules.

They said platforms like national securities exchanges (NSEs), designated contract markets (DCMs), and foreign boards of trade (FBOTs) are allowed to offer these products, including ones with margin or leverage.

The move follows calls from the President’s Working Group on Digital Assets, which pushed for better guidance to keep blockchain innovation in the U.S.

“Today, the Divisions provide their view that DCMs, FBOTs, and NSEs are not prohibited from facilitating the trading of certain spot crypto asset products,” the statement said.

The SEC and CFTC invited companies to contact them with plans or questions about listing crypto spot products.

Tokenized Assets Help Fuel DeFi’s Growth

The adoption of tokenized real-world assets is one reason DeFi lending is expanding. These are digital versions of things like Treasury bills, used as collateral on blockchain lending platforms.

As more firms use stablecoins and tokenized assets in DeFi, the space becomes more attractive to investors used to traditional finance. These firms are seeking ways to increase yield while staying inside regulatory limits.

Tokenized assets make it easier for institutions to move capital into DeFi, offering better speed and flexibility than older systems. Binance Research sees this trend continuing as more financial products become digitized and integrated into decentralized networks.