Bitcoin remains under pressure as it struggles to hold above $87,000. The price has failed to recover key levels lost during last week’s drop. At the same time, Pi Network’s native token has jumped to its highest level this week, supported by speculation of a possible update.

Other altcoins also posted mixed results. TAO and ENA led the gains, while Ethereum saw increased activity from large holders. Exchange reserves for ETH continued to fall, adding to a trend that has developed over the past few months.

Bitcoin Still Below Key Level

Bitcoin briefly recovered after falling under $81,000 last week but has been unable to build momentum above $88,000. It touched $89,000 on Tuesday before pulling back again. At the time of writing, the price is hovering around $87,000.

Market analysts have pointed to the $88,800 level as a key area to watch. According to Joao Wedson, CEO of Alphractal, this price reflects the average cost basis of active investors.

“If Bitcoin stays below this level, people might get nervous and begin selling,” he noted.

Price action around this point could influence short-term sentiment.

Bitcoin reached a high of $107,000 earlier in November but has since dropped by more than $25,000. The recent decline has put pressure on both investors and miners. Bitcoin’s market cap is now around $1.735 trillion, with a market dominance rate of 56.4%.

PI Token Sees Strong Move

Pi Network’s PI token reached a weekly high above $0.25 after showing a double-digit gain. Traders linked the move to talk of a potential update, although no official details have been confirmed. The increase stands out in a mostly flat altcoin market.

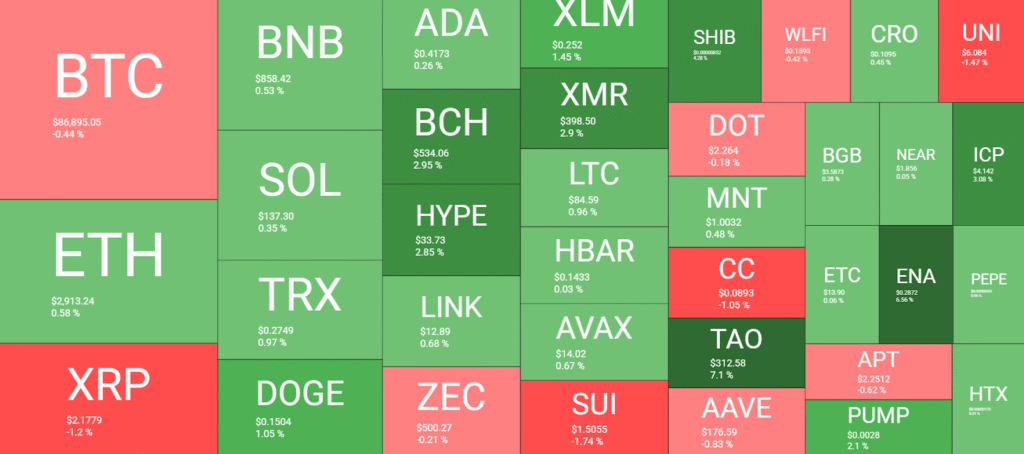

Large-cap tokens such as ETH, SOL, BNB, ADA, DOGE, and LINK made small gains, while XRP and ZEC saw slight losses. TAO and ENA showed stronger moves, rising 6.5% and 6% respectively. BCH, SHIB, XMR, and HYPE added up to 4% each.

Source: QuantifyCrypto

The total crypto market cap is stable at around $3.075 trillion.

Ethereum Whale Wallets Expand

Ethereum dropped by 1.1% on Wednesday, but behind the scenes, large holders have continued to build their positions. Wallets holding between 10,000 and 100,000 ETH now own more than 21 million ETH — the highest ever for this group. Wallets with over 100,000 ETH also increased their share to 4.3 million ETH.

At the same time, ETH reserves on exchanges have continued to fall. Binance now holds just under 3.8 million ETH, down steadily since September. This suggests that more holders are moving funds into cold storage or staking platforms.

Whale activity has also picked up. One well-known trader, tracked by Arkham, recently added $10 million to their long ETH position. The total size of the position is now $44.5 million. Within an hour of the move, it had already generated gains of over $300,000.

On-Chain Data Shows Price Pressure

Several on-chain signals are pointing to stress in the Bitcoin market. The Puell Multiple — which tracks miner income — has dropped below 1, a level often associated with miner losses. This level is sometimes seen during price lows, when coins trade below what miners typically earn for their work.

At the same time, large wallets holding at least 100 BTC have grown in number. Since November 11, 91 new addresses have entered this group. In contrast, wallets with smaller balances have declined, showing a possible shift from retail traders to larger players.

Whether Bitcoin can push above $88,800 remains a key question in the days ahead. The market continues to watch this price level closely, as it may influence whether the current trend reverses or more selling takes place.