Key Takeaways:

- Ethereum drops 7%, testing the $4,000–$4,200 support zone.

- Derivatives data shows aggressive long liquidations.

- BitMine adds 264K ETH despite market downturn.

- Analysts cite $3,600–$3,800 as next support if $4,000 breaks.

Ethereum Tests Critical $4,000–$4,200 Support After Sharp Drop

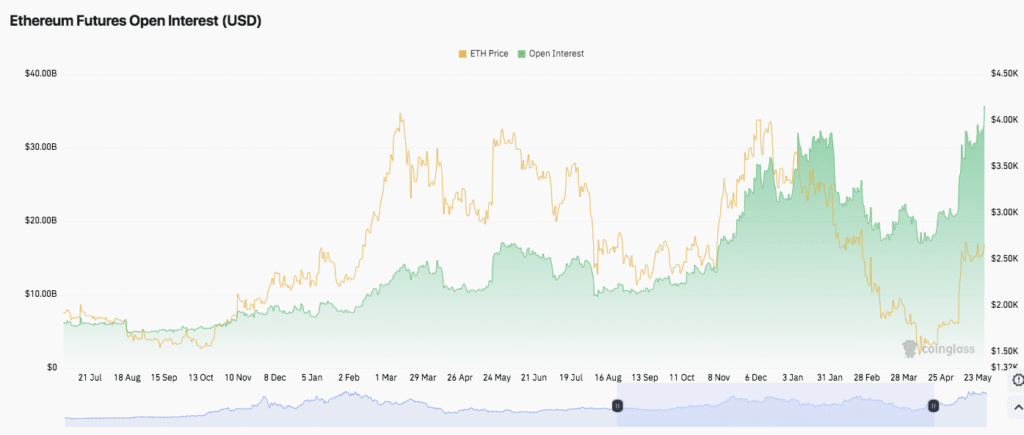

Ethereum (ETH) saw a sharp 7% price decline to $4,140 on Tuesday, falling below its key $4,200 support. The drop marks ETH’s lowest level since early August, triggered by aggressive selling in derivatives markets and a sharp decline in open interest.

The decline wiped billions off Ethereum’s market capitalization, which now stands near $505 billion. Analysts flagged the $4,000–$4,200 region as a critical accumulation zone. If this range fails to hold, downside targets include $3,600–$3,800, with deeper support at $2,630 based on historical demand levels.

According to CryptoQuant data, open interest and funding rates have turned negative, reflecting heightened bearish sentiment. Long liquidations accounted for over $489 million in the past 24 hours, contributing to a total of $516.3 million in ETH futures liquidations.

Derivatives Signal Capitulation as Funding Rates Turn Negative

The current downturn appears driven by a capitulation event. Derivative metrics show long positions being aggressively closed, evidenced by falling open interest and net taker volume across major exchanges.

Funding rates across exchanges are now negative, indicating that short positions are paying less to remain open. This imbalance between buyers and sellers often signals temporary bottoming structures as speculative longs exit their positions.

Analysts like Michaël van de Poppe have identified this zone as a potential accumulation area. He referred to the price action as a “market flush” and pointed to the $4,100–$4,000 range as a likely entry zone for long-term traders.

Traders are scaling into ETH within the $4,000–$4,200 band with defined risk management strategies. Should ETH reclaim levels above its 50-day Simple Moving Average (SMA), currently breached for the first time in over two months, sentiment may recover.

BitMine Adds 264K ETH Despite Price Drop, Boosts Holdings to 2.4M ETH

In contrast to the prevailing market sentiment, Ethereum treasury firm BitMine Immersion (BMNR) expanded its ETH holdings by acquiring 264,378 ETH worth $1.1 billion. The move brings its total holdings to over 2.4 million ETH, valued at more than $10.13 billion.

The firm disclosed that the purchase was funded through a $365 million direct stock offering and a $913 million warrant deal. Chairman Thomas Lee stated that the offering was completed at a 14% premium to the firm’s prior closing price, underscoring shareholder confidence in Ethereum’s long-term value.

BitMine’s continued accumulation reaffirms institutional interest in Ethereum, even as the asset faces near-term technical pressure. However, shares of BitMine fell nearly 10% following the announcement, trading around $55, in line with broader declines in crypto-related equities.

ETH is also now trading below the 50-day SMA, with the Relative Strength Index (RSI) below neutral and the Stochastic Oscillator in oversold territory. While bearish momentum dominates, these technical indicators hint at the possibility of a short-term bounce if buyers defend the $4,000 level.

Price Levels to Watch: $4,000 Support and $4,500 Resistance

Traders are watching the $4,180–$4,200 price band closely. If ETH stabilizes above this zone, it may attempt to reclaim the $4,500–$4,600 resistance, a region that has repeatedly rejected price advances in recent weeks.

Failure to hold the $4,000 support could result in a deeper correction toward $3,700–$3,800. A break below $3,600 would expose ETH to longer-term support near $2,630, a level not tested since Q2.

For now, the market remains in a vulnerable state, with Ethereum traders balancing the risk of further declines against potential accumulation at key historical support zones.