The US Federal Reserve reduced its benchmark interest rate by 25 basis points on Wednesday. This is the second consecutive cut, aimed at supporting the labor market and easing financial conditions.

The move was widely expected by markets and comes during a period of limited access to official economic data due to a government shutdown. Following the announcement, Bitcoin’s price dropped over 3% and is now trading near $111,400.

Interest Rate Reduced as Labor Market Shows Strain

The central bank lowered its target rate by 0.25%, continuing a trend seen in the previous meeting. The decision follows signs of slowing in job growth and other employment indicators.

With key economic reports currently unavailable, policymakers based their decision on available private data and market trends. The shutdown has delayed updates on inflation and labor statistics, making recent policy decisions more challenging.

In addition to the rate change, the Federal Reserve announced it will end its asset reduction program on December 1. This move ends the current phase of balance sheet tightening, which has been in place for several months.

Bitcoin Drops After Fed Decision, Then Recovers Slightly

Bitcoin traded in a narrow range between $112,000 and $113,000 ahead of the announcement. After the interest rate cut was confirmed, BTC dropped quickly, falling to just over $109,000 before recovering above $110,500.

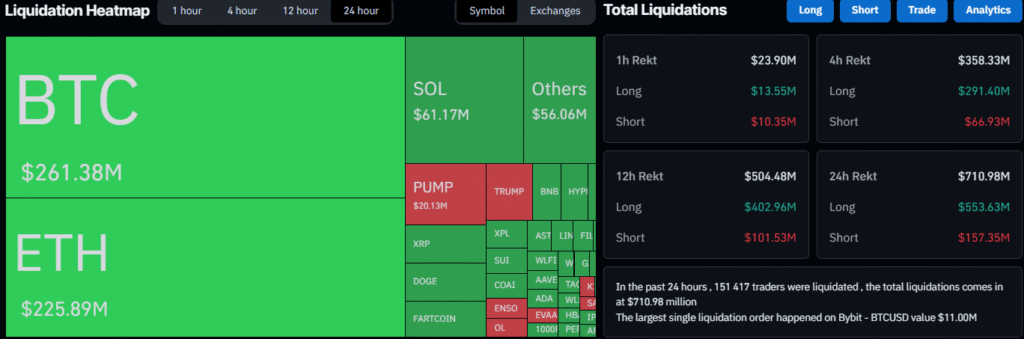

The price drop triggered a spike in liquidations across derivatives platforms. Over $560 million in positions were closed throughout the day. More than half occurred within four hours of the rate announcement.

Market data suggests that this movement may have been connected to a previously unfilled CME gap created during the weekend rally. This price level has now been tested and filled, which some traders believe could mark a short-term price reset.

Altcoins Follow Bitcoin in Broad Market Correction

The price drop was not limited to Bitcoin. Ethereum fell below $3,850, while XRP declined to under $2.55. Several mid- and small-cap tokens experienced sharper declines, with double-digit percentage drops seen across multiple assets.

Total liquidations in the crypto market reached over $700 million in the last 24 hours. Data shows that more than 151,000 traders were affected. The largest single liquidation, valued at $11 million, occurred on Bybit.

The overall cryptocurrency market capitalization now stands at $3.86 trillion, based on figures from CoinGecko. This marks a noticeable decline from recent highs seen earlier in the week.

Liquidation Data on CoinGlass

Policy Decisions Continue Without Updated Government Data

Due to the ongoing government shutdown, several major economic reports have not been released. This includes updates on inflation, employment, and consumer spending. Without this data, policymakers and traders are relying on limited sources to assess the economy.

The Federal Reserve is expected to monitor market reactions closely as conditions develop. Until full data reporting resumes, rate decisions may continue under higher uncertainty. Financial markets, including crypto, are likely to remain sensitive to further policy changes.