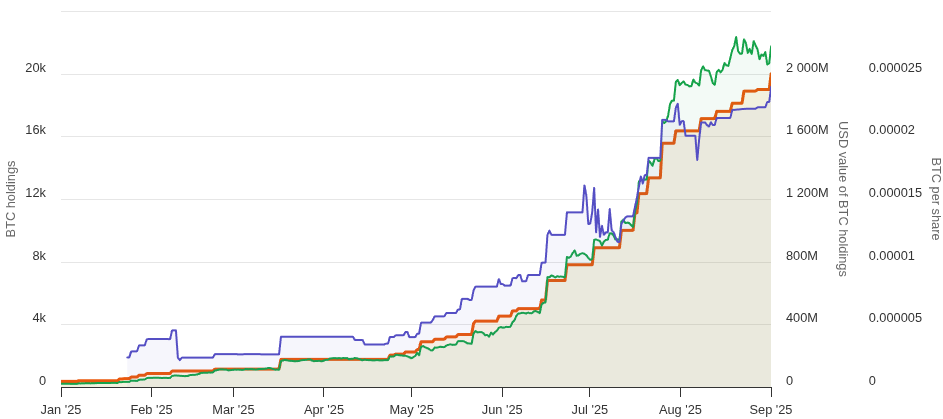

Metaplanet, Japan’s largest corporate holder of Bitcoin, has added 1,009 BTC to its treasury. The purchase brings its total holdings to 20,000 BTC, valued at over $2 billion based on current market prices. The company made the announcement on September 1, stating it spent about 16.5 billion yen, or roughly $112 million, at an average price of $111,068 per coin.

The buy follows a series of large transactions in recent months. Metaplanet had previously crossed the 10,000 BTC mark earlier this year and has since doubled its position in less than three months.

New Shares Issued to Support Strategy

Alongside the BTC purchase, Metaplanet issued 11.5 million new shares. The shares were taken up by Evo Fund through a warrant exercise. Evo Fund purchased 10 million shares at $5.67 and another 1.5 million at just under $6, contributing around $65.7 million to the company.

The firm used part of the funds to redeem roughly $20.4 million in outstanding bonds. Evo Fund still holds the right to acquire up to 34.5 million more shares in the future.

Metaplanet is also moving ahead with a larger capital raise. It has outlined plans to secure 130.3 billion yen ($880 million) through an international offering. A shareholder meeting is set to decide whether to approve the issue of up to 555 million preferred shares, which could raise as much as 555 billion yen ($3.7 billion).

Stock Down Despite Growing BTC Holdings

Metaplanet’s stock has fallen 54% since mid-June, even though Bitcoin has gained about 2% during the same time. The drop has raised concerns about the sustainability of its funding model.

Some market watchers have noted that lower share prices may limit the firm’s ability to raise new capital. Falling stock prices may reduce liquidity, making it harder to finance additional BTC purchases.

Despite the recent decline, the stock remains up 135% year-to-date, based on Google Finance data. Shares fell 4.5% on the day of the announcement.

Shareholder Meeting and Future Plans

Metaplanet has made several high-value Bitcoin purchases over the past month. These include 463 BTC for $53.7 million, 518 BTC for $61.4 million, and 775 BTC for $93 million. The latest 1,009 BTC deal was the largest in this series.

The company has increased its year-end Bitcoin goal from 10,000 BTC to 30,000 BTC. Most of the newly raised capital is expected to go toward additional BTC purchases in September and October.

A shareholder meeting in Tokyo is scheduled to vote on the next phase of the funding plan. Eric Trump, who joined the company as a strategic adviser in March 2025, is expected to attend. Metaplanet referred to him as a leading voice and advocate of digital asset adoption worldwide.