Key Takeaways:

- Solana’s active addresses have fallen to a 12-month low, signaling waning memecoin activity.

- Despite bearish price action, Solana’s DeFi infrastructure continues to grow, with TVL hitting $10 billion.

- Solana faces resistance near $160, with potential price support around $144, indicating market vulnerability.

Solana (SOL) has faced a decline in both its price and active network engagement, as trends from earlier this year begin to fade. With a current price of $153.76, Solana is down 0.55% in a day, reflecting broader bearish sentiment across the market.

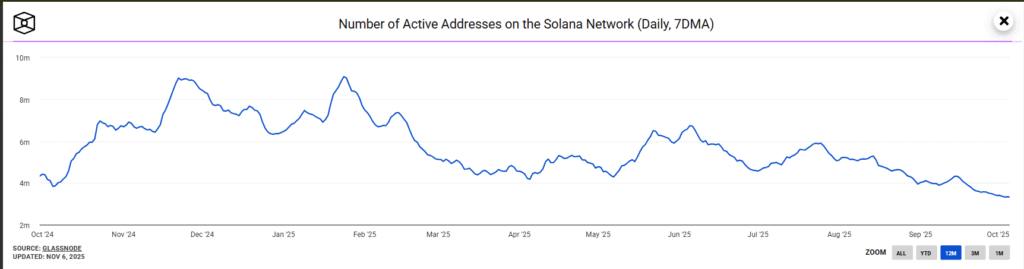

Additionally, active addresses on the network have fallen to a 12-month low of 3.3 million, marking a sharp decline from its peak of over 9 million in January 2025.

Solana’s Price Decline Amid Market Pressure

The price of Solana has been under pressure since the start of November, with its 50-day moving average ($194.67) and 200-day moving average ($180.38) both positioned higher than the current price of $153.76. This indicates a strong downward bias, which reflects the broader market volatility. Solana’s trading has fluctuated between $151.50 and $160.96 today, with a market cap of approximately $71.7 billion and a trading volume nearing $197 million.

Despite a strong 2025 high of $294.33, the recent downtrend shows the vulnerability of Solana’s market performance. Price forecasts suggest resistance near the $160-$164 mark, while support is anticipated closer to the $144 range. In the event of further market deterioration, Solana could dip as low as $120.

Active Addresses Fall as Memecoin Trend Fades

One of the key factors influencing Solana’s current price is the notable decline in active addresses. At the height of Solana’s popularity in late 2024, the network saw a surge in memecoin trading, with Solana becoming a dominant platform for such tokens. However, as the memecoin frenzy fades, active addresses have dropped significantly, indicating that many traders have pulled back.

In January 2025, Solana recorded more than 9 million active addresses, but by November, the number had fallen to just 3.3 million.