- Strategy builds a $1.44 billion liquidity reserve

- CryptoQuant warns of extended Bitcoin bearish pressure

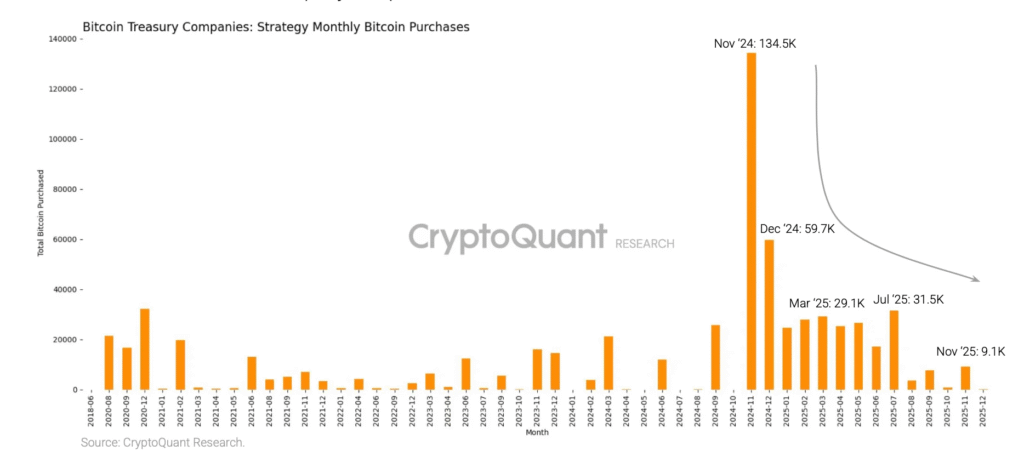

- Bitcoin accumulation slows sharply in late 2025

To ensure it maintains a firm footing amid a declining Bitcoin market, Strategy has established a $1.44 billion reserve. The relocation is representative of the liquidity protection shift, making the Strategy Bitcoin reserve a key instrument, with the analysts predicting long bearish markets. According to CryptoQuant, the company now seeks stability after years of aggressive Bitcoin accumulation, reflecting its response to the market’s increasing volatility.

Strategy strengthens liquidity as BTC volatility rises

The company used the reserve created from the proceeds of a recent at-the-market share issue. The fund is now one year of dividends and debts, and it is planned to grow to a 24-month buffer. CryptoQuant took this to mean that the strategy expects less Bitcoin price performance and even more pronounced downfalls. It was also reported that capital markets could no longer accommodate frequent equity issuance, a practice the company had relied on heavily between 2020 and 2025.

Strategy has adopted a dual-reserve format: cash and substantial Bitcoin holdings. CryptoQuant says this will reduce the risk of forced asset sales in sharp declines. The new model replaces the firm’s previous one, which focused on rapid bitcoin acquisition through convertible debt and equity sales.

Bitcoin buying slowdown weakens market demand signals

The move has ramifications on the wider crypto market as well. The declining Bitcoin buying by Strategy undermines one of the demand channels that formerly aided price movement in bull markets. Nonetheless, analysts noted that cash reserves and access to hedging tools reduce vulnerability to panic-induced liquidation events, thereby promoting long-term market stability.

The accumulation of Bitcoin in strategy has drastically reduced in 2025. The prices decreased by 134,000 BTC to only 9,100 BTC each month in November 2024 and November 2025, respectively. In December, the company only added 135 BTC. This deceleration was accompanied by a sharp decline in Bitcoin to an all-time high of $126,080 on October 6. The cryptocurrency, however, has fallen by more than 25% and is trading at $93,051 at the time of writing.

Market indicators turn bearish despite a steady MSTR rating

CryptoQuant also noted that its Bull Score Index fell to zero; the last time was at the beginning of 2022. Julio Moreno, the firm’s head of research, estimated that Bitcoin would trade between $55,000 and $70,000 over the next year, provided that things remain as they are. Moreno also explained that the Strategy Bitcoin reserve marginally enhances the likelihood of selective Bitcoin sales but would sell derivatives first to hedge holdings.

MSTR received an outperform rating by investment bank Mizuho Securities after the reserve announcement. Strategy CFO Andrew Kang told investors that the reserve is nothing but a liquidity tool. He indicated that the company would still raise the buffer if its multiple-to-net-asset value is above 1, so it could meet its obligations without selling Bitcoin. Kang also added that Strategy can support operations for more than 3 years at the current Bitcoin price.