- UK crypto ownership fell to 8% in 2025

- FCA data shows the biggest decline since 2021

- Remaining investors hold larger crypto portfolios

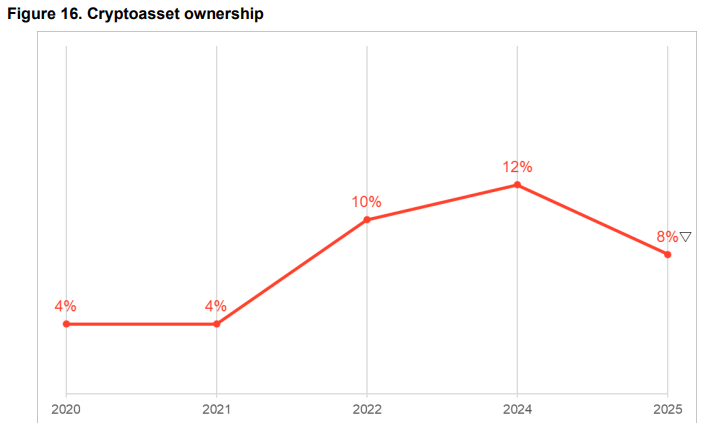

Latest statistics from the Financial Conduct Authority indicate that UK crypto ownership has registered its greatest fall in four years. According to the FCA Crypto Asset Consumer Research 2025 report, only 8% of the UK adults currently have digital assets like Bitcoin and Ethereum. The decline is in the wake of increased prices of cryptos and is a sign of poorer retail activity in the market. As FCA data points to, the investor behavior has changed after the long-term volatility and regulatory uncertainty.

FCA data evidence of a drop in crypto ownership in the UK

According to the FCA report, the number of UK crypto owners dropped dramatically down to 12% in 2024, when approximately seven million adults stated that they owned digital assets. As of 2022 (and 2021), ownership was at 10% and slightly above 4%, respectively; thus, the most recent decline is the most sustained since the market started growing in the years of the pandemic.

UK crypto ownership

The regulator explained the decline by the fact that it is still the aftereffects of the market collapse in 2022, which was caused by the collapse of the large companies like FTX. Numerous retail investors that left the market at the same time have not come back. The pressure of macroeconomic factors, growing interest rates, and geopolitical tensions created more pressure, which heightened the instability in the market and decreased the risk-taking behavior of households.

Confidence was also shattered by forced liquidations in times of severe price volatility. Although the crypto prices improved in some parts of 2024 and early 2025, the involvement did not improve correspondingly, which highlighted an increasing dissonance between the performance of the market and the involvement of the masses.

UK Crypto holders remaining grow portfolio sizes

Although there was a decrease in the overall adoption, FCA data reveal that the rest of the participants are more dedicated. The percentage of crypto users in the UK who had a portfolio worth between 1,001 and 5,000 increased to 21% in 2025. Meanwhile, the proportion of investors with under £100 in digital assets decreased significantly.

This move implies consolidation and not growth in the UK crypto market. More seasoned investors are seen to be adding exposures, and the small and first-time investors are still leaving. Bitcoin and Ethereum are the most popular assets, with a trend towards going to the time-tested cryptocurrencies in unstable market circumstances.

Generation Crypto regulation and political attention rise in the UK

Since the UK is experiencing a falling crypto ownership, there is an increase in political and regulatory focus. Some of the political factions have also started to venture into the digital asset industry, which they perceive as a source of revenue and voter engagement. This tendency is a reflection of the 2024 election cycle in the US.

There is also an increasing regulatory pressure. Even though the European Union has adopted the Markets in Crypto Assets framework and the United States is considering new legislation, the United Kingdom is still in the process of creating a broad regime. FCA is also consulting rules regarding exchanges, staking services, and market abuse, and consultations are still open until February 2026. The licensing will probably start in the latter part of that year, with complete enforcement coming in 2027.