Key Insights

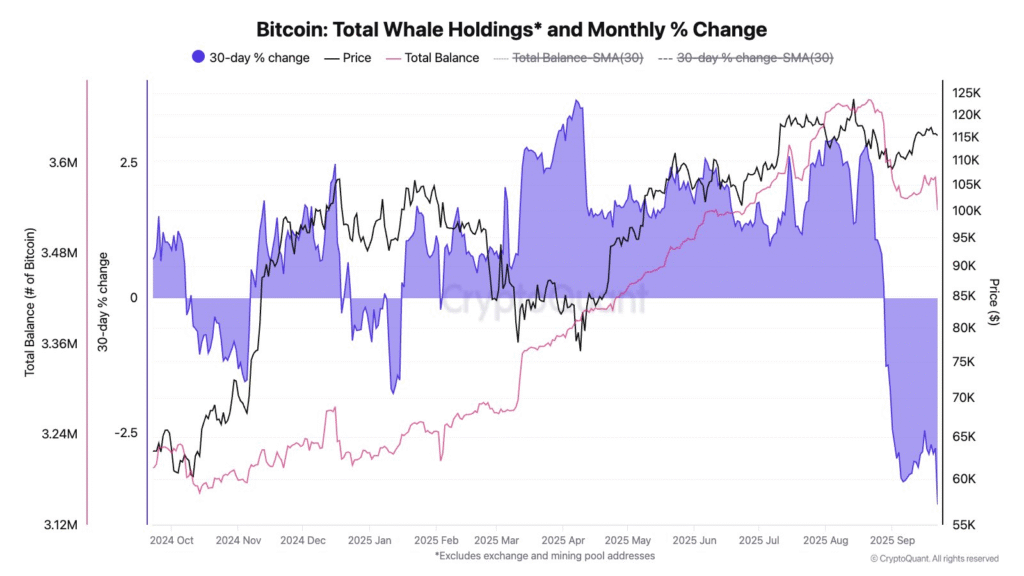

- Bitcoin whales cut 147,000 BTC, equal to $16.5B, adding pressure to prices.

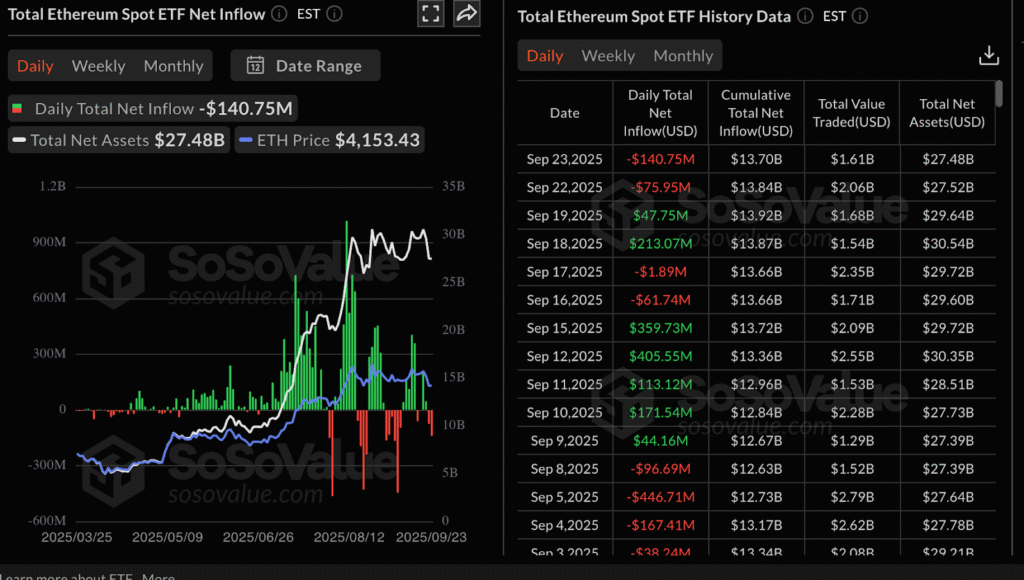

- Ethereum ETFs in the U.S. face $217M outflows across two consecutive trading days.

- Bitcoin trades near $112,500, with short-term support at $111,868 closely monitored by traders.

Bitcoin’s price has swung within a tight range over the past day. On September 23, the asset climbed above $113,000 before slipping to $111,400. The retreat followed comments from Federal Reserve Chair Jerome Powell, who pointed to weakness in the labor market and warned that asset prices appear “fairly highly valued.”

After the drop, buyers pushed Bitcoin back toward $113,000, but the move stalled. At press time, the asset changes hands near $112,400. Its market value is steady at $2.24 trillion, with a dominance of 56.16% over the broader cryptocurrency sector.

Altcoins Mirror Bitcoin’s Pullback

The majority of major altcoins have moved lower alongside Bitcoin. Ethereum has slipped 1% to below $4,200, while Solana has dropped 4% to $210. Hyperliquid registered a deeper fall, shedding 10% to trade under $44. Ripple and other large-cap assets also struggled during the session.

Not all tokens posted losses. Aster climbed 40% to $2.33 after the launch of its decentralized exchange. Immutable rose 10% to $0.75, and smaller gains were recorded by Quant, Sky, and Pi Network. Despite these exceptions, total market capitalization has decreased by 0.7% to around $3.98 trillion.

Whale Activity Adds Pressure

On-chain data suggests Bitcoin’s recent turbulence is linked to large holder behavior. Figures from CryptoQuant show that whale wallets have reduced their holdings by 147,000 BTC in the past two months. At current market levels, the reduction equals roughly $16.5 billion.

Source: CryptoQuant

The same data set shows a steady monthly decline in balances held by whales. Market watchers note that if this trend continues, Bitcoin could struggle to maintain support above $111,868. Failure to hold this level may open the way for another test below $110,000. On the other hand, if the level holds, Bitcoin could attempt a recovery toward $116,000.

Institutional Flows Remain Weak

Institutional demand for digital assets has softened. Ethereum spot ETFs in the United States reported outflows on consecutive days this week. According to SoSoValue, Monday saw $76 million leave the products, followed by $141 million on Tuesday.

Source: SoSoValue

The withdrawals point to caution among larger investors as market volatility persists. Continued weakness in ETF flows could delay Ethereum’s push toward its record high of $4,956. Instead, analysts warn ETH may slip under $4,000 if selling pressure intensifies.

Bitcoin is back near $112,500, recovering mildly after falling to $111,042 earlier in the day. Traders have been watching short-term support levels and whale activity to see where the next move takes them. With institutional flows drying out and volatility holding camp, conditions remain quite uncertain for Bitcoin and altcoins in general.