Key Takeaways

- Higher low structure above 2.20 dollars underpins an XRP bullish signal.

- Exchange supply has dropped over 45 percent in 60 days, easing selling.

- Short heavy derivatives positioning increases the odds of a sharp upside squeeze.

Analysts are watching a developing XRP bullish signal as price action forms a clear higher low while derivatives and on chain data align in favor of buyers. Market analyst Trader Rai highlights the 2.20 dollar support zone as the key level that keeps this structure intact and frames the current continuation setup.

XRP has been carving out rising lows on the chart, even as broader crypto sentiment cools. Each dip has attracted earlier buying interest, suggesting that buyers are becoming more confident and are prepared to defend support rather than waiting for deeper discounts. This step pattern often appears when a trend is shifting from reactive bounces to more organised accumulation.

Trader Rai notes that holding above 2.20 dollars would confirm that buyers are absorbing sell orders at higher levels. From there, focus shifts to the next resistance cluster around 2.30 to 2.35 dollars and the upper boundary of the declining channel that has contained price in recent weeks. A clean move through those bands would upgrade the XRP bullish signal from early continuation to a more established breakout phase.

Exchange supply shock strengthens XRP bullish signal narrative

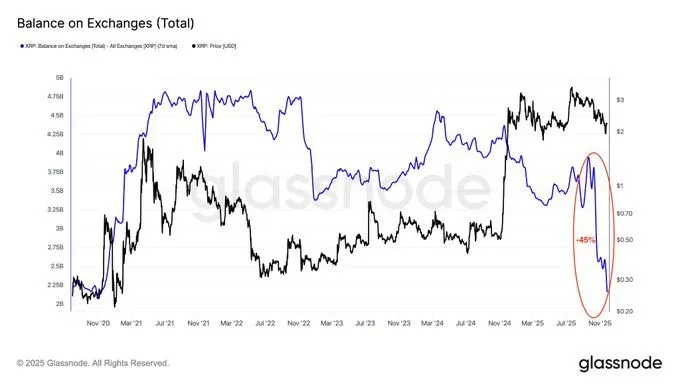

On the spot side, data shared by market expert Xaif Crypto points to one of the sharpest XRP supply contractions on exchanges in recent years. Glassnode figures show that balances on centralised platforms have fallen more than 45 percent in just 60 days, sliding from about 3.95 billion tokens on 21 September to roughly 2.6 billion by 27 November.

Removing over 1.3 billion XRP from liquid exchange supply in such a short window suggests that a significant share of holders are opting for self custody or longer term allocations. Xaif Crypto argues that this shift reflects a move away from short term speculation towards strategic positioning, with whales and long horizon investors driving much of the accumulation.

For market structure, a shrinking float typically reduces immediate sell side pressure. When fewer tokens sit on exchanges, it becomes harder for sudden waves of supply to cap rallies, especially if demand increases at the same time. In that context, the on chain supply shock acts as a fundamental backdrop that reinforces the XRP bullish signal visible on the price chart.

Derivatives positioning and liquidity skew favor an upside squeeze

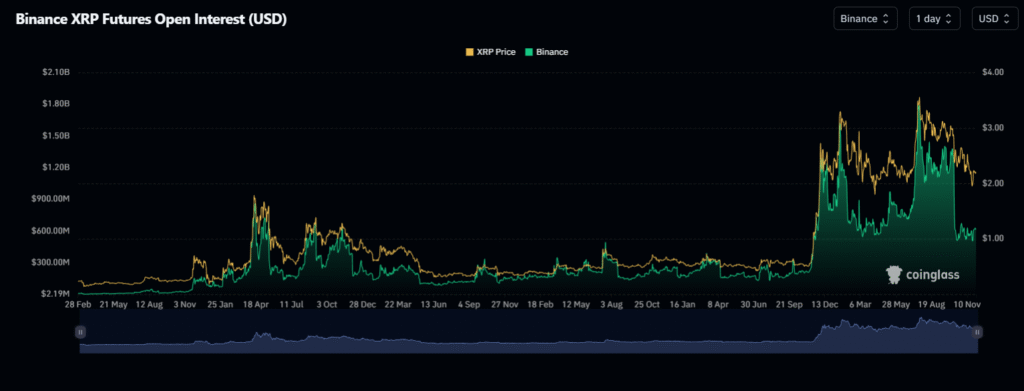

Derivatives metrics add another layer to the setup. Funding on XRP perpetual futures sits near 0.0022 percent, a level analysts describe as low but positive, indicating that open interest is heavily tilted toward shorts while longs pay very little to maintain positions. In this environment, traders see a market that is short loaded rather than euphoric, which can be a contrarian indicator.

At the same time, XRP continues to trade within a declining channel, yet buyers have started to reenter from the lower boundary, according to recent XRP USDT charts. Rising long to short ratios on major venues like Binance and OKX coincide with that rebound, showing that some participants are positioning for a counter move rather than pressing the downside.