Key Takeaways

- Nearly 300M XRP left Binance in October, signaling rising accumulation and reduced selling pressure.

- XRP’s exchange reserves hit a 2024 low as investors shift tokens to private custody ahead of November.

- With historical November gains averaging 88%, XRP’s tightening supply may fuel a potential breakout.

Nearly 300 million XRP tokens exited Binance in October 2025, triggering renewed speculation of a supply shock and setting up expectations for a potential end-of-year rally. According to on-chain analytics provider CryptoQuant, Binance’s XRP balance dropped from over 3 billion to approximately 2.74 billion—the lowest since mid-2024. This trend, also mirrored on exchanges like OKX and Bybit, suggests investor accumulation as XRP enters its historically strongest month.

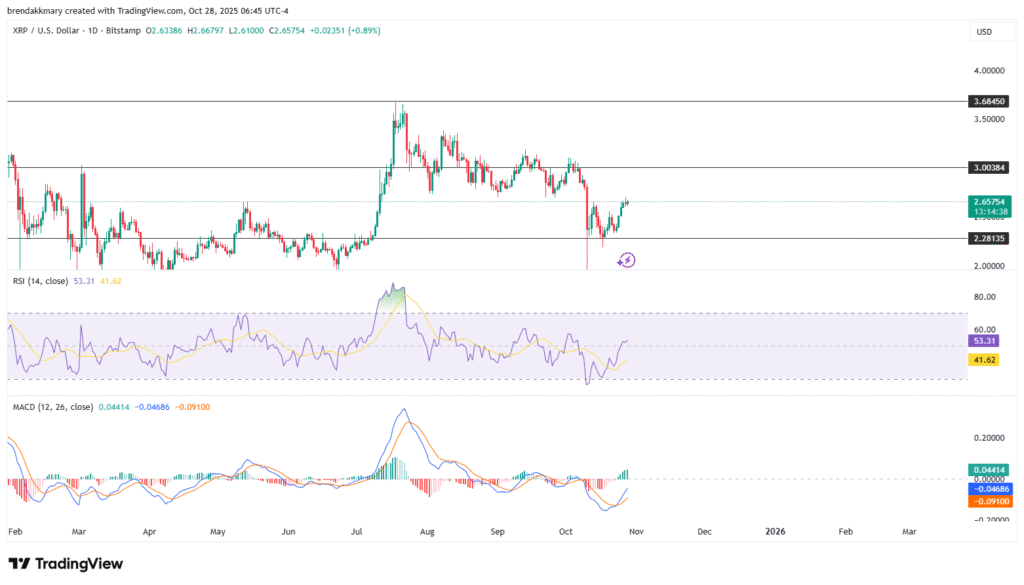

This development comes as XRP trades around $2.66, hovering near key resistance at $2.70. Technical analysts have noted a symmetrical triangle breakout and a bullish falling wedge pattern that could push XRP above $2.80 if momentum sustains.

Reduced Selling Pressure Support Bullish Outlook

Data indicates a rapid decline in exchange-held XRP reserves across major platforms, typically seen as a sign of reduced short-term selling pressure. CryptoQuant charts show a consistent drawdown through October, confirming the trend. Investors appear to be shifting XRP into private or institutional wallets, signaling long-term confidence despite the token’s 4.68% decline month-to-date.

The behavior contrasts with XRP’s typical October performance, where historical data shows seven out of the last twelve years ended negatively. Still, on-chain accumulation suggests a strategic shift. The current market behavior aligns with expectations of increased institutional involvement in XRP ahead of major regulatory and market developments.

November Seasonality and Technical Setup Align for Potential Upside

Historically, November has been XRP’s best-performing month, averaging gains of 88%. With exchange reserves at multi-month lows, analysts suggest this seasonal trend could align with renewed momentum, especially if resistance levels are breached. Current support stands between $2.61 and $2.63, while resistance stretches from $2.70 to $2.81.

Technical indicators bolster this outlook. XRP’s 50-day moving average stands at $2.77, just above the 200-day average of $2.61, indicating bullish alignment. The MACD shows the signal line lagging the main line, while RSI remains neutral around 51–55. A breakout above $2.81 could target zones near $3.10, with long-term projections ranging between $7–$9 if historical patterns repeat.Volume spikes exceeding 100 million XRP during breakout attempts reinforce growing market participation, suggesting that XRP may be preparing for a major price move as supply on exchanges tightens.